Chapter 22 - Broker/Salesperson Relationship

Learning Objectives

At the completion of this chapter, students will be able to do the following:

1) Explain the difference between an independent contract and an employee.

22.1 Broker and Salesperson Compensation

Transcript

There are many wonderful things about working in the real estate industry, from the joy that comes with helping someone find their dream home to the satisfaction received from being an important part of the community as you help people buy and sell their homes. But as with any job, one of the best parts is getting paid. With previous jobs, you may have received a pay check every couple of weeks or so, and you would know more or less how much you’d make at the start of each workweek. In real estate, there are some key differences in how you make money and how you are paid. So, let’s take a look at this important topic.

The Broker/Salesperson Relationship

We’ve previously mentioned that you’ll be a real estate salesperson or agent when you start out. And in order to receive your license you will have to have it filed with a broker. This broker will sponsor your license, and your license must always be held by a broker while you are a practicing salesperson. While it’s common to say that you work for your broker, it’s a bit more accurate to say you work under your broker, for while it can often seem like your broker is your boss, you are in fact an independent contractor, and not an employee of either the broker or the agency for which you work. We’ll discuss further what it means to be an independent contractor in a later lesson, but in order to understand how real estate brokers and salespeople are paid, it’s important to understand the basics of this relationship.

First let’s take a look at how a broker is paid.

For sales, a broker is most often, although not always, paid a commission. This commission is calculated based on a percentage of the final sales price. There is no set percentage that determines how much a broker will make. Rather this is a point of negotiation when a broker tries to get a listing, and what the commission percentage will be, must be clearly laid out in the listing agreement.

While you may have heard about 6% commissions, that does tend to be the high end of what a commission is, and many savvy brokers will offer commissions that are a little lower to beat out competing brokerages for good listings. Additionally, there are a newer crop of brokerages and startups that offer sellers to only pay extremely low commissions, such as 1% or even less! Recently, the industry has also seen companies that sell themselves to potential sellers based on only charging a flat fee upon the sale of the house. This way the seller knows exactly how much they will have to pay their broker from the start.

In order for a broker to have earned a commission for one of their listings, it’s actually not necessary for the sale on the house to close! Legally, the broker only needs to find a buyer who is “ready, able and willing.” If the broker has found a seller who is legally and financially able to buy the property and is “willing” to proceed with the purchase, then technically, their job is done, and they have earned their commission. That means if the seller decides not to sell after entering into a listing agreement and the broker has found a ready, able and willing buyer, then the seller owes the broker the commission. However, it’s important to note that in practice, the broker will very rarely collect a commission on a sale that is not fully executed or completed, although it is not so uncommon for a seller to withdraw a property after a “ready, willing and able buyer” has been found. Why does the broker rarely collect this money that they have legally earned? The best way to do well in real estate is to have a stellar reputation, and when brokers collect money for a house that was never sold, they’re not doing their reputation any favors. What’s more, it will usually take a lawsuit to collect that commission for a sale that never closed, and between the legal fees and the additional damage that will cause a reputation, it’s just not worth collecting that commission.

The last thing to know about a broker’s commission is that it’s very common that the broker will not keep the entire commission, but will need to split it with other brokers, usually with a buyer’s broker. Again, there is no set way in which this split would happen. It’s a point of negotiation where the split must be agreed upon before any deal can be finalized. Oftentimes, a brokerage will have a policy for how much it offers in a split commission, although again, these are generally guidelines and are dependent on the specific deal.

Let’s take a look at an example. A broker has signed a listing agreement to sell a home for a 6% commission. A buyer’s broker approaches the selling broker with a couple who would like to purchase the house for $750,000. They agree to split the commission, and at closing the seller’s broker is paid $45,000. They then must pay the buyer’s broker $22,500 and keep the same amount as their own earned commission.

Now let’s see how a salesperson is paid.

The most important thing to know about being a salesperson is that you may only be paid directly by your sponsoring broker. It is illegal for you to collect a commission or fees directly from a client, and it’s also not allowed for you to be paid from a different brokerage that does not hold your license. When a salesperson has participated in a completed transaction, any commissions or fees are paid to the broker, and then the broker will pay the salesperson.

Most often, a salesperson has an agreement with their sponsoring broker about what percentage of a commission they will get. Again, there is no set way in which this split must occur. A salesperson and broker might agree to a 50/50 split, or it may be 60/40 or it could be 25/75. Additionally, a brokerage might set different levels of involvement that will determine the split for a sale. For instance, it could be that the showing agent gets 40% of a total commission, while an agent who does some follow up work to help close the deal receives 10%. Nowadays there are even brokerages that offer salespeople 100% commission and charge a monthly “desk fee” at a flat rate.

Let’s take a look at an example of a how a commission split would work out. Let’s say that a seller’s agent and buyer’s agent have worked together and closed a deal on the sale of an $820,000 house. Both have a 50/50 split with their respective brokers. The seller’s broker had settled on a 6% commission in the listing agreement. This means that the full real estate broker commission the seller will pay is $49,200, which they pay to their broker. The seller’s broker now must pay the buyer’s broker $24,600, and also they will pay their salesperson $12,600. Once the buyer’s broker has collected the $24,600, they will pay their salesperson $12,600.

Key Terms

Commission

An agent’s compensation for performing the duties of agency; in real estate practice, a percentage of the selling price of property, percentage of rentals, etc.

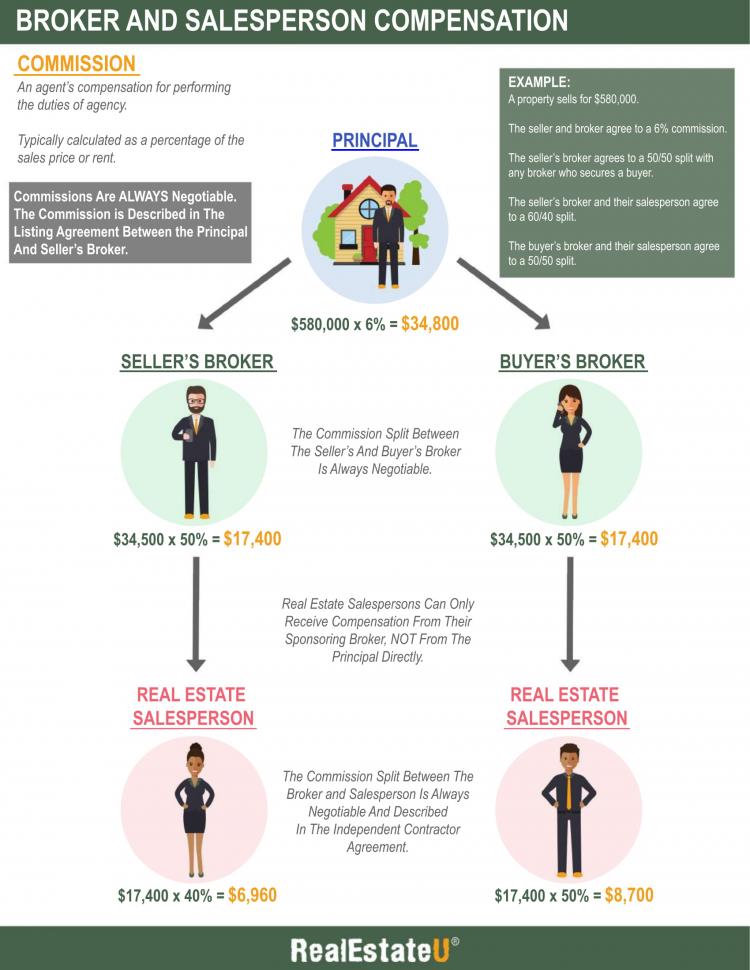

22.1a Broker and Salesperson Compensation Infographic

Please spend a few minutes reviewing the Infographic below.

22.2 Independent Contractor vs Employee Status

Transcript

In the last lesson we touched on the fact that a salesperson is not an employee of a broker or an agency, but is in fact an independent contractor. Now, let’s take a closer look at the difference between those two things, and what it means when you are an independent contractor.

Remember how there are different agencies that set the rules for real estate? Just like some of the laws that affect how you do your job as a salesperson operate on the state level and some on the federal level, there are different agencies that have determined the legal status of your employment as a real estate salesperson. In this case, the two agencies that are relevant to defining how the job of a real estate salesperson works are the state licensing board which will grant you your real estate license, and the IRS, who you will be paying taxes to once you begin making money.

State licensing views the relationship between the salesperson and the broker as much more like a traditional employee/employer relationship. There are many other professions where a person is an independent contractor for another person or company, but in those contractual agreements it’s common for the independent contractor to assume all liability for their own actions. In real estate, a broker is viewed as having responsibility over the salespeople that they hire, and are acting as supervisors.

This is one of the reasons why it’s so important that a salesperson and their sponsoring broker make an independent contractor agreement. Somewhat like an employment agreement, this lays out what both the salesperson and the broker can expect from each other.

Because a real estate salesperson must file taxes as an independent contractor, and not as an employee of the agency for which they work, there are a number of rules that the IRS makes that define what an independent contractor is and what they are not.

Because you are not an employee of your broker, your broker is not allowed to tell you what hours you have to work. You determine what your work schedule is. Your broker is also not allowed to set a work location. While it is often conducive to business to do many tasks in the office, if you and a client decide to meet at a Starbucks, your sponsoring broker can’t tell you not to, and if you decide that you’d prefer to spend the morning doing online marketing from home, the broker does not have a say. It’s important to remember that while a broker does not get to tell you when or where to work, if they don’t like the ways in which you conduct business, then they can release your license, also known as getting fired. So if you prefer to work late into the evenings and on the go, but the broker you’re thinking of working with believes strongly in the virtue of working in the office, from the crack of dawn, then perhaps you are not a good fit. Most brokers are accepting of different styles of work, so long as they get deals done while maintaining integrity.

The broker is also not allowed to pay the salesperson a salary. As an independent contractor in real estate, all of your earnings must be commission-based. This is a commission from your dealings with the broker, not your dealings with the client. If the broker always does a flat fee with the clients, and you have agreed to a 50% split, then you would receive 50% of the flat fee paid to the brokerage on your deals. Sometimes you will see a brokerage that offers to pay new agents a weekly draw when they get started. While this might look like a salary, it is in fact an advance that will be paid back by being deducted from future earned commissions. A real estate agent may receive bonuses, such as when the top earning agent in an office gets additional compensation each month, but the IRS prohibits independent contractors from being compensated for the number of hours worked. A salesperson may only be paid for the services they have provided.

The final thing that a broker cannot do is control the activity of the salespeople they have hired. They can however supervise that activity. If they see you doing something that is against ethics or against the law, then acting in a supervisory capacity they will tell you to stop. Additionally, a good broker will also guide their salespeople in how to best attract clients and close deals. When you think of the fact that it is you, and not the broker you are working under, who is in control of all of the actions you take in the real estate industry, it’s a good idea to think of your career in real estate as not a job, but as a business, your business. And it is your responsibility to take the actions to make that business thrive and grow.

As a salesperson you will also have additional responsibilities including paying for your own expenses, such as travel and supplies. A brokerage might choose to pay for advertising for clients or the company, as well as general office expenses, but expenses that you incur, including those for things that you use to build relationships with the client and attract customers are your responsibility. A salesperson is also responsible for all of their own memberships and education. While a brokerage will usually purchase MLS for the entire office, if you want to join the National Association of Realtors you must pay your own dues, as well as the costs of licensing and taking classes.

The IRS requires several things of employers, which are not required of people hiring an independent contractor. An employer must withhold taxes from what is paid to their employees, and they also must contribute social security taxes. In many instances, an employer is also required to provide health insurance for employees. Because salespeople are independent contractors, not employees, none of these things pertain to them. And while it might seem great that no taxes will be deducted from your pay, it just means that paying your taxes will be your sole responsibility, which is the topic of a future lesson.

Key Terms

Independent Contractor

A person that provides services to another under terms specified in a contract or within a verbal agreement. An independent contractor is not an employee.

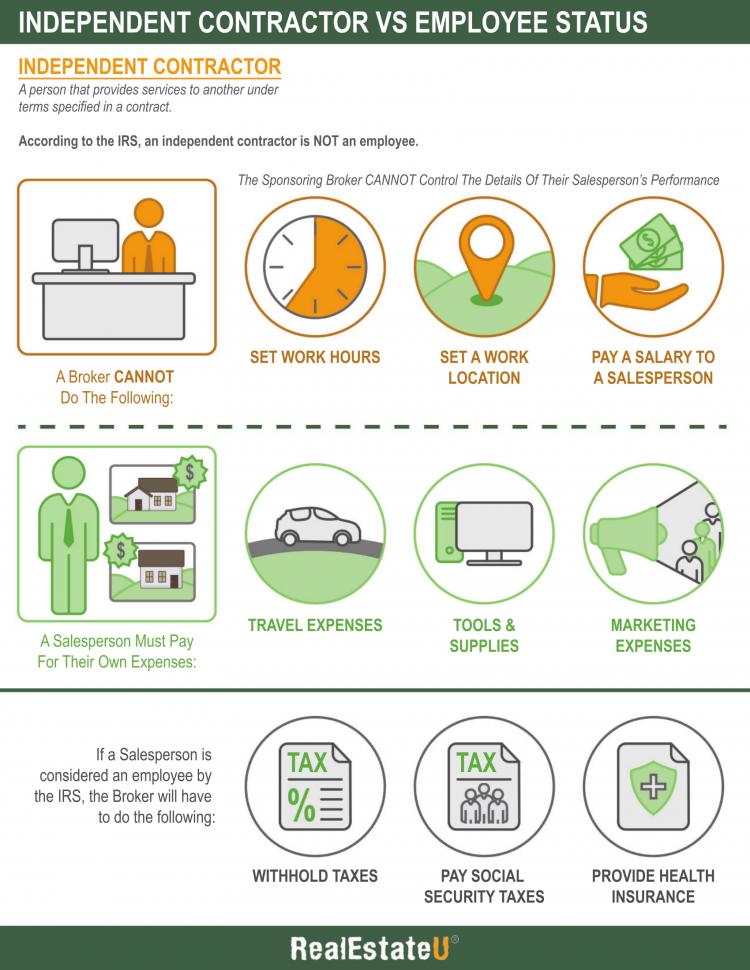

22.2a Independent Contractor vs Employee Status Infographic

Please spend a few minutes reviewing the Infographic below.

22.3 Independent Contractor Agreements

Transcript

We've already gone over how an independent contractor relationship is different from that between an employee and an employer. And you may have gathered that in many respects it's a lot looser. When you work for someone, as an employee, there are many rules and laws, at the state and federal level, that outline specific things that your employer must provide you with and is responsible for. This includes information on how they pay you, also the fact that might be required to pay extra for overtime, as well as the many laws that regulate how an employer may terminate the relationship with their employee, whether it is through firing or laying off.

Because there are not nearly so many regulations that define the different aspects of a relationship in an independent contractor situation, it's extremely important to take the time and carefully define what the independent contractor is as well as whom the client is and what each expect from each other. In a general independent contractor situation, the independent contractor is contracted by their client, however, as we've already discussed, in real estate, this is not the typical independent contractor relationship. The broker, working with the agent, isn't the same as a client, nor isn’t he the same as a boss who is subject to all employment laws. By having a clear independent contractor agreement, it is easy to navigate what could otherwise by a complex and confusing relationship.

Previously we discussed how the IRS distinguishes between an employee and an independent contractor. The independent contractor agreement serves as an important part in maintaining that distinction. It is a requirement to show that the agent is not an employee. Much of what is laid out in the agreement is to prohibit there being any expectations that are specific to employees, and are prohibited to the role of an independent contractor. While we saw that much of what regulated that an agent was an independent contractor came from the IRS, at the federal level, there are common law tests that some states have put into effect to separately define what an independent contractor is as opposed to an employee. In cases where those common-law tests are still in effect, the more restrictive regulations should be followed. In other words, if a state is stricter in defining what an independent contractor is, then that is the rule that must be followed.

Here are some of the features that are important to have in mind when talking about independent contractor agreements.

The relationship will always be between a licensed broker and a licensed salesperson, and the agreement will state that the two parties to the contract each meet that respective requirement. A large part of what is included in the agreement are features which must be addressed in all independent contractor agreements, not just real estate. There will often be a statement regarding liability—who is responsible in the case of legal challenges. An independent contractor does "work made for hire." Unless the contractual agreement states otherwise, the contractor likely has the right to the work they create, including copyright.

When a person hires an independent contractor, for example to design a logo or write an article, it's important to contractually agree that the client will own that work that they are paying the contractor to create. This is a bit less relevant in real estate, but when it comes to creating listings, copy for MLS, photographs and other advertising and marketing materials, this is relevant. If a salesperson uses the agency's template to create a dozen current listings, and then leaves the agency, do they still own the listings they have written?

A good agreement will clarify that just like the salesperson cannot take the listings with them when they go, it will also carefully distinguish between what marketing materials they have a claim for and which they don’t. If you pay a professional photographer to take photos of a property, and leave the agency, but the agency wants to continue using the photographs, you should be able to receive some reimbursement for those photographs.

The agreement will lay out the distinguishing characteristics of being an independent contractor that we've already gone over. Additionally, you may be pleased to find that as an independent contractor you are allowed to hire someone to assist you. This could be an assistant to manage your paperwork, an accountant to help with budgeting, or the aforementioned photographer. This will help you give your listings that extra competitive edge.

The agreement won't just state what the salesperson can and cannot do to make sure they maintain status as an independent contractor, it will also outline what expectations are from both parties. It's likely these will be in sections that will be titled something like "Obligations of Broker" and "Duties of Salesperson." While there are templates that will allow people to properly create this legally binding contract, both the broker and the salesperson have the option to add additional information to these sections if there are further expectations of duties or obligations, or if they feel like having clarifications that would help the relationship run smoothly.

Money matters and it is with the Independent Contractor Agreement where it is laid out how a salesperson is paid by their broker. As mentioned, in order to be an independent contractor, the salesperson must be paid primarily by commission, and never by the number of hours worked. However, how the commission is split between the salesperson and the broker is fully negotiable. Once an agreement has been reached as to what split will determine the salesperson's pay, it's vital to enter that information into the Independent Contractor Agreement. This solidifies the understanding regarding pay into a legally binding agreement.

Eventually even the best of things come to an end. Depending on what state you live in, how an employee’s status is terminated is subject to different rules. With an independent contractor, it’s universally a pretty simple thing to end the relationship. Both the broker and the salesperson have the right to terminate their relationship at any time. There does not need to be any reason given. In the Agreement, there should be a clause laying out the logistics in order to make that separation as simple as possible. It’s likely that this section will state how much written notice should be given to formally terminate the agreement, as well as what procedure should be followed to determine if the salesperson is owed additional commission and how that should be paid.

Key Terms

COPYRIGHTED CONTENT:

This content is owned by Real Estate U Online LLC. Commercial reproduction, distribution or transmission of any part or parts of this content or any information contained therein by any means whatsoever without the prior written permission of the Real Estate U Online LLC is not permitted.

RealEstateU® is a registered trademark owned exclusively by Real Estate U Online LLC in the United States and other jurisdictions.