Chapter 26 - Listing the Property

Learning Objectives

At the completion of this chapter, students will be able to do the following:

1) Describe at least three types of listing contracts.

2) Explain the difference between a CMA and an appraisal.

3) Explain how negative and positive adjustments are made on a comparative market analysis.

4) List at least three types of fiduciary duties owed by the broker to the principal, and provide an example of each.

26.1

Transcript

A listing contract is also called a listing agreement and it acts as a contract between a real estate broker and a seller who is the owner of real property. The listing contract gives the broker the authority to act on behalf of the seller as an agent in the sale of real property included in the agreement.

The people who sign the contract include the Principal (the seller) and the broker. As a real estate agent, you will act as a salesperson on behalf of your broker.

For example, if your neighbor comes to you and asks you to put his or her house on the market, you may prepare the listing agreement, but you will not be able to sign it. You have to get your broker to sign it. Your broker is the legal owner of the relationship.

Anatomy of a Listing Contract

A listing contract will contain the following parts.

- Duration of the Listing Contract. The length of the contract can be three months, six months, a year, or any other period you choose. The seller will want to keep this as short as possible in order to be able to terminate the relationship if no sale occurs. The broker will need to ensure the period is long enough to cover the time and effort as well as the expense of marketing the home.

- Sales Price. This is the desired price of the seller, which should reflect a realistic amount a buyer would be willing to pay.

- Sales Commission. The commission is always negotiable between the principal and broker. If the commission rate is too low, a listing broker may fail to push the house in all effective advertising channels. The selling broker may concentrate on other prospects with a higher commission potential.

- Exceptions to commission. This absolves the seller in whole or part from paying commission if they find a buyer themselves. Generally, if the seller finds their own buyer, they had to have listed them in the listing agreement as a potential buyer.

The seller usually pays very close attention to the listing agreement, and will likely request a lawyer to review it. It is vital that the seller understands what they are signing. Once a broker presents a willing and able buyer, if all conditions have been fulfilled, the seller owes the broker his or her full commission. This holds true unless the terms in the listing agreement say otherwise.

If the seller chooses not to sell (if for instance he is not happy with sales price, or decided not to move), the commission must still be paid, unless the terms of the listing agreement are altered to account for it. For example, the seller could have appended a note to the agreement, such as, "Commission is payable at close of escrow, dependent upon the close of escrow."

Exclusive Right to Sell Agreement

The Exclusive Right to Sell Agreement is a listing agreement wherein a broker agrees to act as agent for the seller of real property, where under the terms of the agreement, the broker is entitled to a commission if the property is sold during the time the agreement is in effect. This includes any buyers brought in by the seller or another broker with or without the services of an agent.

The Exclusive Right to Sell Agreement is the most commonly used listing contract and the one that offers the most protection to the broker. With very limited exceptions, it provides that the broker will receive a commission on the sale of the home for a certain period of time. Even if the seller finds a buyer through another broker or finds their own buyer, the Listing Broker will receive a commission. Sometimes, if a seller has interested buyers, they have them excluded from the Agreement. However, it is likely that some small fees and/or commission will still be required by the Listing Broker to compensate for their time and expenses.

In exclusive-right-to-sell listings one broker acts as the sole agent of the seller and has exclusive rights to represent the property while the contract is in effect. The broker receives a commission even if another broker or the owner sells the property.

Let’s discuss an example of how this might occur.

Bill wants to sell his home and hires Broker Justin as his Listing Broker. Before signing the Exclusive Right to Sell Agreement, Bill runs into his old neighborhood, Tom, at a friend’s pool party. Tom says that he has been trying to move back to the neighborhood but that there were rarely any listings. Justin claps him on the shoulder and says that maybe they could help each other out.

Tom is unable to commit right away, but wants to be considered a potential buyer for the property. With a sigh, Bill realizes he will have to go ahead and sign the Exclusive Right to Sell Agreement with Justin, but he wants a break on the commission should Tom come back with a solid offer. Justin reluctantly agrees to waive the commission if Tom buys the home, on the condition that he is reimbursed for his MLS fees and the costs of advertising. They shake on it, but since verbal agreements aren’t legal binding, Justin adds it to the Exclusive Right to Sell Agreement.

What happens if the seller is unhappy with an offer?

If the seller is unhappy with the sales price offered, she can turn it down, even with an Exclusive Right to Sell Agreement. If the Listing Broker failed to advertise the property or make a solid effort to act in the Sellers best interest, the seller has recourse to break the contract.

From the seller perspective, the Exclusive Right to Sell Agreement is the most restrictive and gives the seller far less control than other types of agreements. If at all possible, the seller will opt for a less restrictive contract.

Exclusive Agency Agreement

In the Exclusive Agency Agreement the seller employs a broker as the sole agent for the seller of real property. In this role, the broker will receive a commission if the property is sold through another broker, but the broker receives no commission if the sale is negotiated by the owner without the services of an agent.

With the Exclusive-agency listing the broker will receive a commission only if he or she procures the buyer, or if the seller hires a single broker as the exclusive agent of the property owner, or if the seller retains the right to sell the property independently without paying commission

Difference between Exclusive Right to Sell and Exclusive Agency

When you examine the actual contracts the difference boils down to a few words buried in the text. Even though the difference is small, with the rest of the forms being nearly identical, they have a big impact on whether the listing firm will be entitled to compensation for certain types of sales.

An exclusive right-to-sell agreement offers the listing firm commission if a sale occurs, and it doesn’t matter whether the broker, the seller or someone else procured the sales, the listing broker gets paid in all cases.

On the other hand, an exclusive agency agreement stipulates that the seller only pays the commission if the listing firm or another real estate firm finds the buyer.

So, in the nutshell, this means that there will be situations where the listing firm is not entitled to compensation, even if the property sold. In the exclusive agency agreement, if the listing firm (or another firm) secures a buyer only then has a claim on compensation.

Here is an example.

After entering into an Exclusive Agency agreement with XYZ brokerage firm, Mark decided to sell his property to his cousin, John. John found out about the house, being available for sale, from Mark’s daughter at a family event and did not speak to the listing broker or any other brokerage regarding the listing. In this case, John will probably not have to pay any commission, since the buyer was procured through his own efforts and knowledge.

In the same example, imagine that John first found out about the house being up for sale through property listings that his agent emailed him from the Multiple Listing Service. In this case, the listing broker (and the buyer broker) might argue that they are entitled to compensation. They have to prove that their efforts produced the buyer first, which can be difficult to do.

In the same situation, under an exclusive right to sell, the listing firm could still claim the right to compensation no matter how John learned of the property’s availability. These examples show the true intention of the exclusive right to sell, to protect listing brokers who have produced a ready, willing, and able buyer. This includes the seller finding a buyer for the property.

Open Listing

An Open Listing is an authorization by the owner of real property to a real estate agent that gives the agent the nonexclusive right to secure a purchaser. Open listings may be given to any number of agents without liability to compensate any except the one who first secures a buyer ready, willing, and able to meet the terms of the listing, or secures the acceptance by the seller of a satisfactory offer.

An open listing is a non-exclusive, unilateral real estate contract. This means that more than one broker may be employed to sell a single property, and the owners may act on their own behalf to procure a buyer without being liable for commissions to the listing brokers. In an open listing, the owner of the home agrees to pay a commission to whoever procures a ready and willing buyer first. Therefore, it offers brokers the lowest level of protection when compared to other types of listing agreements.

A unilateral contract is a legally-enforceable promise, entered into by competent parties, that obligates one party to do as specified legal service for another. A unilateral contract specifies the conditions under which one person pays the other to perform a certain duty. If and when the duty is fulfilled, funds are exchanged. In the case of real estate, this means that the listing broker who secures the buyer gets paid, but that no listing broker is obligated to secure a buyer.

A non-exclusive agreement means two parties are entering agreement that services will be performed, but more than one party may be contracted to perform the same services.

An open listing might be viable for a broker if the property will be very easy to sell or in a super-heated market, where buyers are willing to pay higher prices, and when finding a buyer is not an issue. Homeowners present this to as many brokers as possible. Brokers may already have interested clients and pursue the listing. However, since an open listing is not exclusive and it is difficult for any one broker to complete the sale, most brokers will not have much interest in pursuing it.

In reality, most brokers ignore open listings on the MLS since there’s no guarantee they’ll earn the commission. Because of this, open listings are not very common.

Here is an example.

Donna decides to sell her home using an open listing, which she sends to dozens of brokers in the area. It takes a few months, but since the market is hot and the home is relatively new, with many improvements, that increase the value, she eventually is contacted by a broker, Mike, with a willing and able buyer. During the walk-through, the buyer gives Donna her business card, and she later contacts Donna. They agree on a sales price and decided to circumvent the broker who facilitated the sale. Mike could pursue legal action but doesn’t, chalking it up to a lesson learned.

Net Listing

In a net listing, the seller tells the real estate agent what price they want to get out of the listing. The agent then adds their desired commission to the net price. Net listings are fraught with peril and are illegal in some states.

Here are some of the things that can go wrong in a net listing agreement.

- If the agent obtains a purchase offer far in excess of the seller's net sales price, the seller may feel like they have been treated unfairly or accuse the sales agent undervaluing the market value of the home to inflate their commission.

- If the agent receives a low purchase offer too close to the net price, they can receive little or no commission for their efforts, yielding the listing agent little or no compensation. This presents a temptation not to present the offer to the seller.

Here is an example.

Rosa accepted a net listing from Donald to list his home for sale. The fair market value of the home comes in at $590,000. Rosa decided to list the property at $613,000, which includes a 4 percent sales commission. Recent sales in the community indicate that this would generate interest and procure a buyer in a reasonable period of time. Rosa received one to two offers below the asking price, which she presents to Donald, despite some hesitation due to the lower commission she will receive. Donald agrees to wait for a better offer so that Rosa will not be shorted on her commission. The market takes a sudden downturn, with comparable homes in the same community selling for $580,000. Donald approaches Rosa to lower the asking price, which she refuses to do based on the impact on her commission.

In this case, Rosa has a conflict between protecting her own financial interests and acting in the best interest of her client. This is one example of how net listings create a danger to both the seller and the listing broker. A better alternative is an exclusive right to sell listing that includes a reasonable listing price formed as the net sales price plus the listing agent's sales commission.

Terminating a Contract

It is important to note that every listing contract is different. As an agent or broker, you have the right to include clauses and stipulations to protect yourself and/or the seller. It is a good idea to verbally review the contract with the seller to ensure they are aware of what they are agreeing to. To avoid misunderstanding, point out any clauses that you add pertaining to the circumstances under which they will be able to terminate the contract, also called the cancellation clause(s).

If the listing broker fails to procure a buyer within the time limit of the listing contract (usually 3, 6 or 9 months), then the contract is null and void at the end of the stated period.

For this reason, brokers usually place a few clauses in their listing contracts to prevent sellers from circumventing the agreement. One clause prevents the seller from canceling a listing agreement without the real estate agent’s written agreement.

Another termination clause states that if an agent has brought a buyer who is willing and able to the closing table, she has earned her commission at that time. So, if the seller unreasonably turns down an offer, they could be liable to pay the commission anyway. While it is good to include this protection in the listing agreement, it is important to execute such clauses with caution. An unhappy seller can quickly tarnish an agent and broker’s reputation and impact future sales.

Another clause that is good to include in your listing agreement places constraints on the sale of the home to anyone the listing agent has shown it to. The seller will not be able to sell the home to these prospects within 6 months to one year after the contract ends.

Key Terms

Exclusive Agency Listing

A listing agreement employing a broker as the sole agent for the seller of real property under the terms of which the broker is entitled to a commission if the property is sold through any other broker, but not if a sale is negotiated by the owner without the services of an agent.

Exclusive Right to Sell Agreement

A listing agreement employing a broker to act as agent for the seller of real property under the terms of which the broker is entitled to a commission if the property is sold during the duration of the listing through another broker or by the owner without the services of an agent.

Listing

An employment contract between principal and agent authorizing the agent to perform services for the principal involving the latter’s property; listing contracts are entered into for the purpose of securing persons to buy, lease, or rent property. Employment of an agent by a prospective purchaser or lessee to locate property for purchase or lease may be considered a listing.

Net Listing

A listing which provides that the agent may retain as compensation for agent’s services all sums received over and above a net price to the owner.

Open Listing

An authorization given by a property owner to a real estate agent wherein said agent is given the nonexclusive right to secure a purchaser; open listings may be given to any number of agents without liability to compensate any except the one who first secures a buyer ready, willing, and able to meet the terms of the listing, or secures the acceptance by the seller of a satisfactory offer.

26.2 Pricing the Property

Transcript

Introduction to Pricing the Property

The sales price is set in the listing contract and is the price at which the seller agrees to accept an offer from an able and willing buyer. When it comes to setting a sales price for the contract, the broker can suggest a price based on a Comparative Market Analysis, or CMA, as well as their knowledge of the most recent sales in the area. Once a CMA is completed, the broker consults with the client. Based on how aggressively the seller wishes to move the property, a listing price is agreed on. Then, the listing contract is signed and becomes legally binding.

The seller may ask for guidance on the final sales price. At this time, the broker or sales agent should walk them through the CMA. Each portion of the CMA needs to be thoroughly explained so that the seller understands how the suggested sales price was derived. If the seller indicates that they want to decrease the sales price significantly, it is the broker's responsibility to explain that they may be accepting an amount far below what they could get for the home. If the seller indicates a much higher value, the property may stay on the market for a long time. The longer the property is on the market, the less likely it is to sell at the asking price.

A word of caution: ultimately, all the real estate professional can do is suggest prices based on the market and on the goals of the seller. The final decision needs to be left up to the seller. If the broker or agent pushes too hard for a higher price and the property does not sell, the owner will be upset and may accuse the broker of padding the price to get a higher commission. At the same time, if the real estate agent is too aggressive and suggests a really low price to motivate a quick sale, the owner may feel cheated.

For example, real estate agent Gabe Brown prepares a CMA to present to seller Wendy Kleinfelter. Recent comparable sales in the area range $250,000 to $270,000, with the suggested sales price coming to $260,000. Gabe tells Wendy to list the property at $280,000, believing that the market is heating up and that, given time, they will get the higher amount. Wendy is very reluctant to agree to this, since she and her husband are moving out of state the following month. Nevertheless, she agrees to the sales price and the listing agreement is signed.

Over the following weeks, several interested buyers do a walk-through, but don't seem to feel that the home is worth the inflated price. No offers are made on the home. In a panic, Wendy finally forces Gabe to lower the listing price and receives an offer for $240,000. Since no other offers materialize, she is forced to accept the deal. However, she files a complaint with Gabe's broker and blogs on-line about her negative experience. Such situations are 100 percent avoidable by keeping the customer in the loop and truly representing their interests.

What is a Comparative Market Analysis (CMA)?

Comparative Market Analysis – An analysis of the competition in the marketplace that a property will face upon sale attempts.

A Comparative Market Analysis, or CMA, is a close reading of similar properties sold in the same market area. Real estate agents put together the CMA for clients in order for them to set a listing price at which a home will be offered for sale. Because no two properties are exactly the same, agents adjust the price for differences between recently sold properties and the subject property to be sold. This yields a fair offer or sales price.

A comparative market analysis is not an appraisal. A formal appraisal can only be performed by a licensed real estate appraiser. An appraisal is the process of estimating the value of real property performed by a licensed professional. Appraisers must receive authorization from a licensing board in their state of residence. Real estate appraisals account for the value of surrounding properties and general market conditions, as well as the condition of the subject property. The appraisal is used to determine the property taxes and potential sales price if the owner decides to sell the property. In a CMA, the agent records the differences between the comparison properties and the subject property that is being sold. It is a less official version of a formal, professional appraisal. Brokers use CMAs to advise clients on a listing price.

CMA Example 1

For example, a Jack Tanner wants to sell his 2,100-square foot home, which has four bedroom and 3 bathrooms. It is a single-family home with a quarter acre of land. Ideally, Jack wants to get $300,000 for the property, so he contacts real estate agent Carrie Lerner to create a comparative market analysis. Carrie identifies 8 other properties that have sold in the area in the past two years. She chooses the three that are the most similar to Jack's home.

- The first matches Jack's house on every point, but sits on a busy road. It recently sold for $275,000.

- The comparison is a four-bedroom, three-bathroom home on a quarter-acre lot. However, it's 2,400 square feet due to an added-on screened-in porch. The sales price was $315,000.

- The third home is a four-bedroom located on a quarter acre of land. It is also 2,100 square feet, but only has two bathrooms which are in desperate need of remodeling. This home sold for $265,000.

Taking into consideration all the properties, Carrie completes a comparative market analysis. The average adjusted sales price is the average of the three properties or $285,000. However, Jack's home has a recently updated bathroom, so Carry places more weight on the first two sales. She presents her analysis and suggests that $300,000 is a fair listing price. Jack decides to list his house at $290,000, giving himself a little wiggle room to negotiate with future buyers.

Let's take an in-depth look at how to put together a CMA.

Experience and Market Area Knowledge

The CMA is not only a comparison. When you prepare your first CMA, you should ask for help from your broker or another sales agent. Eventually, you also will have a thorough grasp of the local market and be able to prepare comparisons based on data presented to you. Your mantra should always be, "Real estate is local." This well-known quote may be overused, but it is true nonetheless. As an agent, you have to know everything going on in your market.

If you only take the sales prices and adjustments into account, you may be at a serious disadvantage. Before assuming anything, make sure that you know the area and the properties extremely well. Without this familiarity, you cannot perform an effective comparison. All this means is that, armed with market data, you can find out why homes in one area sell better and command higher prices. Let's take a look at how comps are selected.

Selecting the Right Comparable Properties

Statistically, sales way above or way below the bulk of available comparables are not useful. Sometimes, there are only a couple of comps to select from, and you have to consider all candidates. However, if you have enough recent comps, throw out highest and lowest sales prices to even out the trending.

Save your notes on the comps that you do not use so that you can justify why you excluded them, if necessary. Clients may question your decision to exclude some properties in deciding on the sales price. It is important to be ready for that conversation, should it arise. Put together comparable properties in the same subdivision as the subject property's, and if no comps are available in recent sales, go to Plan B. In lieu of sales prices in the current neighborhood, you can select homes from another subdivision or even a nearby town.

For example, realtor Helen Guest received a listing in her small rural town. No homes have been sold there in the past year. Helen widens the net and gathers sales data from three neighboring towns to get an idea what listing price she should suggest to the seller. After throwing away an extremely high cash sale and an extremely low short sale, she has three comparable properties left $195,000, $197,000 and $215,000. All three homes are 3-bedroom, 2 bath homes on half-acre lots. The third choice sold for $215,000 because it had a two-car garage versus a one-car garage in the other two homes. Helen suggests $198,000 sales price, adjusted for inflation.

Try not to use comps that are too old, stay as close as possible to the current timeframe. You can try going back in increments, such as the last six months, then the last year and so on. This will be easier in fast markets than slower ones. For comparison properties older than three months, you will probably need to make some subjective adjustments. These adjustments should be specific to the market, and newer agents should rely on their brokers for guidance.

Again, depending on the availability of comparison homes, use homes of the same construction in your CMAs. For example, don't mix one-story with two-story homes. We have an aging population that may value the convenience and safety of one floor. With our aging population, many seniors will be looking for a single story home, so it could be more in demand.

Adjusting Value for Comparison Properties

When you compare properties, you have to adjust for any differences that will have a material impact on the sales price. For example, you wouldn't adjust for minor features such as doorknobs and light fixtures, but you would include any major improvements such as remodeling a bathroom.

Tip: some of these details will be found in the last listing for the comparable properties, although the value of improvements has to be estimated.

Performing the comparison of properties to the listing property is the most difficult and time-consuming part of completing the CMA. The Realtor will select similar properties, then adjust them to conform to the subject house.

Each adjustment represents the estimated increase in value for each item, which is subtracted from the subject property if the subject property does not have the improvement. Items that the property for sale has that the comparable homes do not will increase the suggested sales price of the listing. Here are some items that are commonly adjusted for:

- Add or subtract value for the difference in the lot or acreage size.

Do the same for major feature differences

- Does the property have additional bedrooms and bathrooms?

- Does the home have a garage? If so, how many cars can fit in the garage?

- Has the kitchen been upgraded?

Look for any special financing that could have impacted the sales price.

- Motivated cash buyers may have been willing to pay more for a quick sale, for example.

- Was the sale of the comparable property arm's length? Meaning, were there any special circumstances that would impact the sale, such as selling to a relative?

- Do not include short share or distressed properties in the comparison as these sales will not reflect true market value.

For example, Realtor Abraham Wallace is listing a 3 bedroom, 2 bath home with a one-car garage on a quarter acre lot. His three comparison properties are identical except for the following.

- The first property had a much lower sales price from a cash buyer. The last name of the purchaser is the same as that of the seller. Abraham suspects this was a sale to a family member and decides not to use this property in his comparison.

- The second property has a fourth bedroom. Abraham makes a note of this, determines the value of the additional bedroom to be $15,000 dollars, which he will adjust for in the Comparative Market Analysis.

To look at another common example, you might end up with adjusted comps of $140,000, $150,000, and $160,000. This is a solid range not much higher or lower than the others, which is an indication that the property you are selling will probably fall within that range. However, here is where the craft and skill of an experienced real estate agent come in handy. Where along the range of $140,000 to $160,000 should your listing price fall? This skill is obtained over time and this is again one place where your broker can provide some direction.

Sometimes the most important factor is the motivation of the seller. If the home owner is looking for a quick sale, he might be will to sell at the bottom of the range at $140,000. On the other hand, if the main factor is getting the highest price possible and the seller is in no rush to sell, a list price of $160,000 might be the best listing price.

More Details on Selecting Comparison Properties

Now that we have walked through the adjustment process, let’s take a look at additional factors to consider in selecting comparison properties for the CMA, as well as other factors impacting how to adjust the sales price.

First of all, consider all homes listed in the past six months, including homes that have sold, have sales pending or are expired. Sold listings are the primary tool for determining the value of your listing. Meanwhile, expired listings tell at what price the market will not respond to a listing. Pending listings can help you understand what similar homes are going for in the current moment.

The following are examples of good comparison properties that can be used to determine and adjust the listing price.

Bedrooms

- Homes that have the same number of bathrooms and bedrooms are good comparisons since such a high value is placed on these assets. However, it is also possible to estimate the value of an extra bedroom or bathroom when preparing the CMA, if you feel like a home is one of better choices.

- Homes with square footage within 300 of the listing property. For example, if your home is 2,300 square feet, the range for comparable properties will be 2,000 to 2,600 square feet.

- Because the number of “bedrooms” listed for a home. Generally, more bedrooms equal a higher listing price. It is important to keep in mind that bedrooms can be added onto a home or the house can be carved up to create more bedrooms for a growing family. Here’s the problem, without additional square footage, those extra rooms may not add much value to the property. They may even present legal challenges if the changes are unpermitted.

- Be aware of how the local coding agency defines a bedroom. In some cases, living rooms, dining rooms and sun rooms can be considered officially as “bedroom.”

Homes in the Same Neighborhood

Neighborhood is not just a geographic designation. Figuring out what neighborhood a home belongs to can be trickier that it sounds. For that reason, it is truly necessary to assess the neighborhood as a result of online information. Some homes in urban areas may be a part of master-planned communities with clearly defined boundaries. In other cases, you may need to investigate the local definition of where neighborhoods begin and end. If there isn’t any real agreement on the boundaries, you can refer to the names of nearby highways and shopping centers. In some cases, train tracks are used as the designation.

School District

Select homes in the same school district as your listing. Especially in areas with a demographic of young families, the quality of the schools will be of paramount interest to interested buyers. If there aren’t enough sales in the same school district, be familiar enough with the surrounding school districts, to be able to select from homes in similar school districts. In larger cities, school districts right next to each other can have dramatically different ratings. This usually has a sizable impact on property values.

Here is a resource for you that is helpful: k12.niche.com is a good site to determine the geographical areas for school zones.

Size Matters

Lots in the same neighborhood are probably going to be about the same size. However, larger lots do add to the value of a property. A home on a full acre lot will be worth much more than a similar home on a quarter acre.

Age of Homes

Unless you live in a historical home that has a heritage that will increase the property value, older homes are going to be worth less than newer ones.

For example, a home built in Gettysburg in the 1800’s that once housed garrison Confederate soldiers, is going to be worth far more than a 40-year-old home in disrepair. For comparison properties, select homes within 10-25 years of the listing.

If all homes in a neighborhood were built around the same time, age isn’t really a factor. However, if new construction is available in the area, it will command a much higher sales price or may drive down the value of your listing. This would be a good time to get more familiar with the neighborhood if you aren’t already.

Homes with Similar Amenities

For example, your home has an in-ground pool. Other listings with in-ground pools make good comparisons. Fences in good repair are another amenity to consider. Some amenities are not tangible assets. For example, a home with an ocean view will be able to command a much higher price than a home with no view at all, a few blocks from the beach.

Determine a Price per Square Foot

So, now you have narrowed down the list of comparable properties. You have several homes that are more or less similar to the listing property. Now, it is time to take the price determined for each comparable property and divide by the total square footage to get the price per square foot. This is a great indicator for comparing the value of homes. Finally, calculate the average price per square foot of the all the comparison properties.

You use this average price per square foot multiplied by the exact square footage of the listing home. Now, you can celebrate because you have determined a pretty accurate estimate of the sales price of your client's home.

Let's look at an example. Realtor Ted Johnson is running a CMA for a 3,000 square foot home. He has selected four comparable homes.

- Home one is 2,700 square feet and sold for $499,500 (price per square foot: $185)

- Home two is 3,300 square feet and sold for $541,200 (price per square foot: $164)

- Home three is 2,700 square feet and sold for $415,800 (price per square foot: $154)

- Home four is 3,300 square feet and sold for $617,100 (price per square foot: $187)

We find that the average price per square foot here is $172.50. Multiply 172.50 by the subject property's square footage of 3,000 to get the suggested value for the listing. So, $172.50 x 3000= $517,500.

This is the suggested price for the listing contract to discuss with the seller.

Walkthrough of the Listing Property

Before you can celebrate and sign the listing agreement, there is one final step you should take. You can be very confident of the comparable market value of the home compared to recent sales. Take the opportunity to see the home in person and see if there are any surprises that would significantly increase or decrease the value of the home.

Here are some general considerations that you should lookout for.

- Is the condition of the home much worse or much better than the comparable properties?

- Additions and upgrades. Has the client added a pool, central air or skylights that can increase the value of the property?

- The Property. Is the sidewalk in ill repair? Has the landscaping been redone? The condition of the property impacts the perceived value of the home and is also known as curb appeal.

Adjust the price per square foot and sales price to reflect the differences.

It is difficult to assess the increase or decrease in value that results from the items that you come up with on the walk through. In reality, it is unlikely that the client will surprise you with last minute information about a pool or new A/C. Usually, the types of unknown challenge that come up are revealed during the inspection. Unfortunately, these often involve fixes for plumbing, electrical or other infrastructure work, which can be expensive.

An Analysis of Current Listings

The comparable properties in the last section were sold homes with known sales prices. In addition, you will need to take a look at current listings in the same area that your listing will be competing across. You may need to adjust your suggested list price up or down to be competitive in the marketplace.

In periods of high inventory, you may have to adjust your price downward to be competitive, while a low inventory market may yield you a higher sales price in a seller's market.

For example, Realtor Ashleigh Polanski has completed a CMA on recently sold homes and come up with a suggested sales price of $304,000. However, when she looks at other homes currently on the market, she finds that out of four, only one of them is below her sales price at $280,000. The other properties are all at least $10,000 above what her CMA suggests. She presents these findings to her seller and they increase the listing price to $288,000, or $8000 more than the suggested price based on sold homes, but still competitive in the market.

Present the CMA in an Easy-to-Understand Format

Presentation is also a plus, but making the report "pretty" should not overshadow presenting the report in an easily digestible format that the seller can immediately understand.

Bottom Line

The first time you complete a comparative market analysis may be difficult as you struggle to understand how the data translates into the value of an actual home. However, once you understand how they work, the process is really very straight-forward. It is worth the investment in time to thoroughly understand the report and to get into the habit of not skipping any steps, no matter how tedious.

Key Terms

Comparative Market Analysis

An analysis of the competition in the marketplace that a property will face upon sale attempts.

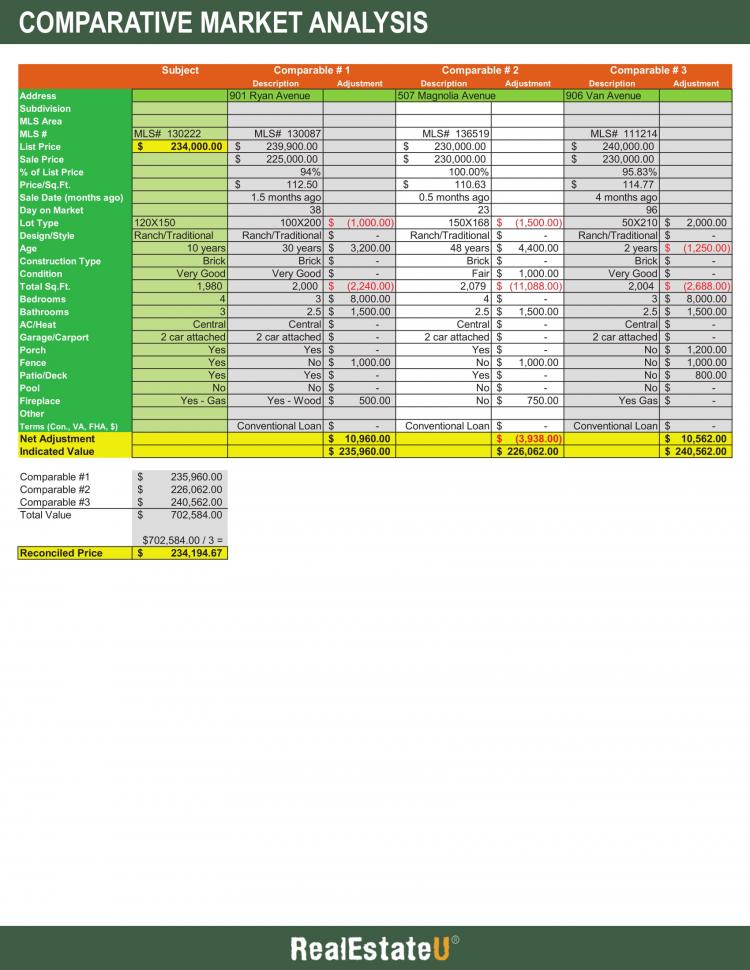

26.3 Example of a Comparative Market Analysis

Please spend a few minutes reviewing the document below.

26.4

Transcript

As a real estate professional, one of your tasks will be to help a home seller arrive at a listing price. Keep in mind, the listing price and the appraised value of a home are not the same thing. A listing price is merely the price point you believe will give the seller the best option for selling their home quickly at the maximum price. To arrive at this price, you will be responsible for creating a Comparative Market Analysis, or CMA.

Generally, you will want to review homes that have sold in the last six months, those that have similar square footage, and have similar characteristics including number of bedrooms and bathrooms. The more similar the properties the fewer adjustments will have to be made. Let’s look at a home being listed for sale, the comparable sales and review the adjustments we made and why they were made.

The subject property is a 10-year-old traditional ranch home. The property has a 2-car garage, central heat and sits on a 120’-0” x150’-0” lot with 1,980 square feet of living space. To get an estimated listing price, we found three other properties that sold within the last six months which were also traditional ranches. While none were identical, there were enough similarities to use them for comparison purposes.

Before we jump into the comparable properties and the adjustments made for each component, let’s take a minute to discuss how the adjustments are made relative to the subject property.

When you are doing a comparative market analysis, you ultimately use the sales prices of the comparable properties as your benchmark. The value of the subject property will be determined relative to the sales price of the comparable properties. For that reason, you have to compare the components of the comparable properties to those of the subject property, and then adjust the value of each component either upwards, downwards, or equal. If one component of the subject property is superior relative to the comparable property then a positive adjustment is used for the comparable property, and vice-versa. If the components are considered equal, or the same, then the value will not need to be adjusted.

For example, if the subject property is identical to the comparable property in every aspect, except the subject property had one more bedroom, the subject property will theoretically be worth more money. Therefore, if the comparable property sold for $200,000, then the subject property should sell at a price higher than $200,000. In the comparative market analysis, the only adjustment made will be a positive adjustment to the ‘bedroom’ component of the comparable property. This will give the subject property a value greater than $200,000.

So, just remember, if the subject property is superior in one component relative to the comparable property, a positive adjustment should be made. If the comparable property is superior, a negative adjustment should be made.

That being said, let’s take a look at how the subject property compares to each of the comparable properties, starting with comp number one. This will show you how the concept of adjustments is used to determine the value of the subject property.

Comparable #1 is located at 901 Ryan Avenue. It was listed for $239,000, but ultimately sold for $225,000 after being on the market for 38 days. The property was sold only six weeks prior.

The subject property has a lot size of 18,000 square feet. However, the comparable property has a lot size of 20,000 square feet. Since the comparable property is larger, the lot is considered more valuable and therefore, a negative adjustment of $1,000 is made.

Keep in mind the adjustment values are based on market data and the experience of the broker. Ultimately, all adjustments are only assumptions made by the broker and are not necessarily perfect.

Next, we compare the styles of the homes. Both properties are ranch style homes, so no adjustment is needed here. They are both considered equal in regards to this component.

Next, we have the age of the property. Since the comparable property is 20 years older, a positive adjustment of $3,200 is used.

Moving down, both properties are built of brick and in ‘very good’ condition. Therefore, they are considered equal and no adjustments are needed.

The two properties differ on total square footage, however. The subject property has 1,980 square feet of living space while the comparable property has 2,000 square feet. Therefore, the larger property is more valuable. Using the calculations for price per square foot, a negative adjustment of $2,240 is made.

Moving down to the number of bedrooms, the comparable property only has three bedrooms while the subject property has four. The result is a positive adjustment of $8,000.

Next, we have the number of bathrooms. The subject home has three bathrooms while comparable property only has two and a half baths. Since three bathrooms are more valuable, a positive adjustment of $1,500 is made.

The next three components are all considered equal and no adjustments are needed. Both properties have a central A/C system, an attached two car garage and a porch.

A $1,000 positive adjustment is added to the fence component since the comparable property does not have a fence.

Both properties have a patio/deck but do not have a pool. These two components are therefore considered equal and no adjustments are needed.

In regard to the fireplace, the subject property is slightly superior. A gas fireplace is considered more valuable than a wood burning fireplace because it is more reliable and requires less maintenance. For this reason, a $500 positive adjustment is made.

Finally, we have the terms of financing. In this case, the broker is assuming the future buyer will also use a conventional loan and therefore no adjustment is needed. However, there are cases where the type of financing could affect the sales price of the property. For example, if a buyer were using all cash, the seller may be willing to drop the price a bit because the buyer will typically close more quickly. An all cash buyer also offers the seller more certainty that they will close on the property since they don’t have to rely on approval from a lender.

When you add up all of the adjustments made to comparable #1, you get a positive net adjustment of $10,960. This means the subject property is theoretically worth $10,960 more than the comparable property. Therefore, $10,960 is added to the comparable #1 sales price of $225,000 to get an indicated value of $235,960.

Next, we go through the same process for comparable property #2.

Comparable #2 is located at 507 Magnolia Avenue. It was listed and sold for $230,000 after being on the market for 23 days. The property sold just two weeks prior.

The lot size is 7,200 square feet larger than the subject property. For this reason, a negative adjustment of $1,500 is shown.

The comparable property is 38 years older, which gives us a positive adjustment of $4,400. Due to its age, the condition is only listed as fair, which also gives us a positive adjustment of $1,000.

Comparable #2 is the largest of the three comparable properties at 2,079 square feet. Based on the price per square foot, a negative adjustment of $11,088 is used.

Like the first comparable, comparable #2 has two and a half baths and does not have a fence. Therefore, the same positive adjustment of $1,500 is used to account for the one-half less bathroom and another positive adjustment of $1,000 is used to account for the value of the fence.

Finally, since comparable #2 does not have a fireplace, a positive adjustment of $750 is used.

The remaining components match those of the subject property, so no adjustments are needed in those cases.

When we add together all of the adjustments from comparable #2 we get a negative net adjustment of $3,938. This means the comparable property is theoretically worth $3,938 more than the subject property. When we add the negative net adjustment to the sales price of $230,000 we get an indicated value of $226,062.

This leads us to comparable property #3, which is located at 906 Van Avenue. Comparable #3 was listed for $240,000, but sold for $230,000 after being on the market for 96 days. The sale of the property took place four months prior.

The lot size is only 10,500 square feet, which is much smaller than the subject property. The width is also much less, which is why a positive adjustment of $2,000 is used.

However, comparable #3 is only two years old, making it eight years newer than the subject property. For this reason, a negative adjustment of $1,250 is used.

The property is also 24 square feet larger, which warrants a negative adjustment of $2,688.

Comparable #3 only has three bedrooms and two and a half baths, which gives us the same positive adjustments used for comparable #1.

Since the property does not have a porch, fence, or patio, three positive adjustments are used to account for the loss of value.

Finally, the remaining components all match the subject property, which means no additional adjustments are needed.

The final net adjustment for comparable #3 is $10,562. When we add this value to the sales price of $230,000 we get an indicated value of $240,562.

At this point, we have three indicated values that theoretically give the value of the subject property. To determine the fair market value of the subject property, we have to take one last step; namely, we have to find the average of the three indicated values.

In our case, the average of the three indicated values is $234,194.67, which is also known as the reconciled price. Based on the reconciled price, the broker determines the listing price as $234,000. This is the price you can feel confident advising your client is the appropriate “target” list price where the home should sell the fastest.

And there you have it! This case study covers the steps a broker takes to determine the listing price for a property. You will conduct many CMAs in your career as an agent and you will most likely go through a similar process as we have just done.

Key Terms

26.5 Fiduciary Duties

Transcript

In this lesson, we will discuss the fiduciary duties an agent owes to their principal.

Before getting started let’s discuss a few key terms.

First, an agent refers to a real estate salesperson or broker acting in a fiduciary role on behalf of the principal.

The principal refers to the seller or buyer of real property who benefits from a fiduciary relationship with a real estate salesperson or broker. The principal is the individual who hires the agent to work on their behalf.

Fiduciary duties refer to the legal and ethical responsibilities an agent owes to their principal.

When you, as a real estate agent or broker, act on behalf of a buyer or seller, you are bound by certain legal and ethical obligations referred to as fiduciary duties. The main thing to remember is to always act in the best interests of the client, as long as that does not mean breaking the law or acting unethically toward another party in the transaction.

For example, Realtor Jake Lucas is the listing agent for Miguel Lopez. Miguel’s neighbor, hoping to buy the property for a lower price, offers Jake full commission plus $1,000 “under the table” if he can get Miguel to agree to the lower deal, which is $8,000 under market value. Jake turns down the neighbor because he has a fiduciary responsibility to Miguel, as the listing agent for the home. It is a good thing that Jake is so ethical, because this particular transaction would be illegal and probably cost Jake his license.

OLD CAR

You can use an acronym to better remember the fiduciary duties an agent owes their principal. The acronym is OLD CAR and here is what each letter stands for:

“O” stands for Obedience

“L” stands for Loyalty

“D” stands for Disclosure

“C” stands for Confidentiality

“A” stands for Accounting …and

“R” stands for Reasonable care

Now, let’s discuss each of these six fiduciary duties in more detail.

Obedience

As an agent, you must obey all legal instructions given by your client and do so in a prompt and efficient manner. "Obey" is not a term that most people want to hear, but just get past that and think about the needs of your client. On the other hand, if your client asks you to perform an illegal act then this rule no longer applies. This may seem very straight-forward, but it can be murky.

For example, it is illegal to discriminate against sellers based on their race or religion. What if a client tells you they only want to sell their home to white Christians because of the demographics of the neighborhood? You then need to explain to your client that your duty is to present all valid offers to them, regardless of race, religion or any other protected category.

Similarly, a seller may ask you to lie about the condition of the property. While you are not expected to be a subject matter expert on architecture, plumbing or electricity, you cannot lie about material defects that you are aware of or that have been disclosed to you. So, if you are the listing agent and your seller tells you the pipes are cracked, or if you see boxes floating in a flooded basement, you have no choice but to disclose that to a buyer. Of course, the best thing is to advise your client to fix the issue prior to the closing.

Obedience to a seller versus a buyer is a bit different.

- The Seller's Agent has to obey the lawful instruction of the Seller, and is not required to fulfill requests from the Buyer.

- An Exclusive Buyer's Agent has to obey the lawful instruction of the Buyer, and is not required to fulfill requests from the Seller.

Loyalty

Loyalty is one of the fundamental duties an agent owes to the principal. This duty requires a real estate broker to act only in the best interests of the client, excluding even the broker's own interest.

- The Seller's Agent is required to do everything in their power to further the interest of the Seller.

- The Exclusive Buyer's Agent is required to do everything possible to further the interests of the Buyer.

For example, Remy Pascal is a broker representing seller Carl Smith. Remy decides that the property is a great candidate for a quick flip and makes an offer on the home. Immediately after purchasing the home, Remy resells it for a profit. In this case, Remy has not acted loyally in safeguarding Carl's interest above his own.

It is not illegal for a broker to make real estate investments, but turning a quick profit on a client you are supposed to represent, is considered theft of an opportunity for profit owed to the seller, or principal.

Disclosure

As an agent, you must tell your client everything that pertains to the transaction that impacts them as part of the agency relationship. This includes facts that impact property value or marketability. It also includes knowledge gained regarding the other party's bargaining position, presenting all offers on the home, information about a buyer's willingness to make a better offer and intentions to divide or sell the property for a higher profit.

NOTE: The duty of disclosure is separate from a real estate broker's duty to disclose material defects of the property to principals and non-principals. Material defect disclosure is part of a real estate broker's duty to treat all parties to a transaction honestly. Honesty is not part of the agency relationship.

- The Seller's Agent has to divulge any known material defects in the property. However, they must NOT divulge information about traffic problems, poor schools, crime rates and declining property values in the area or any other details that make the property less appealing to a buyer.

- An Exclusive Buyer's Agent must disclose everything they know about the seller, including the motivations to sell and any opportunity for a faster sale. They must tell the buyer anything they find out about traffic problems, poor schools, crime rates and declining property values in the area. They must tell the buyer anything that might make the area less desirable to a buyer.

For example, Pace Walker is the buyer's broker for Ellen Rigby. Pace finds out that crime rates have doubled in the last five years and that traffic noise from the highway is clearly audible from within the home. When Ellen asks about property values, Pace not only answers her question, but shares what he knows about crime rates and traffic noise as well. Ellen decides to keep looking, and Pace has fulfilled his duty of disclosure to his client.

Confidentiality

You are required to protect your principal's confidences and secrets, unless it is unlawful to do so. If you know anything that can compromise your client's bargaining position, you have to keep it to yourself and not share it with the other party to the transaction. Here is how that responsibility is different when you represent a buyer versus a seller.

- If you represent a seller you cannot tell a buyer that the seller must sell a property below the listed price.

- On the other hand, if you represent a buyer you cannot tell the buyer that your client is willing to pay more than the offer price presented.

It is important to note that the fiduciary duty of confidentiality extends even beyond the closing of the transaction.

An exception to this rule is if the principal gives the agent permission to disclose certain confidential information. For example, perhaps the principal wants to sell quickly and therefore allows the agent to market the property as a “motivated seller”.

Another exception to this rule is the required disclosure of known material defects that both the listing agent and seller are legally required to reveal.

Accounting

Under the duty of accounting, you are obligated to "account for", or answer for, any property or money that your client has entrusted to you. This includes money, deeds, and any other documents given to you that relate to real estate transactions in which you represent them.

For example, you are the listing agent and the client has given you a deposit for marketing expenses in the sale of their home. You are expected to deposit this money into a separate account and to be able to account for its use.

Reasonable Care and Diligence

As an agent, you are expected and required to use reasonable care and diligence in pursuing your client's goals. The standard of care assumes that, as a licensed real estate broker, you are a competent professional, knowledgeable in your field. By holding a real estate license, you are considered to have expertise above a non-licensed person.

Despite this, a broker is not expected to know details that require a deep understanding of subject matters beyond their licensing requirements. The broker should acknowledge this and refer the principal to the appropriate expert, such as a lawyer, accountants, engineers or other professionals.

- The seller’s Agents are expected to prepare themselves through education, to competently represent the Seller in all matters.

- An exclusive Buyer's Agents are expected to prepare themselves through education as to competently stand up for the buyer at all times.

For example, you are the listing agent for Ivan Beeker, who has recently discovered there is a lien on his property that must be resolved, prior to listing the property for sale. So in this case you refer Ivan to a property attorney and municipal authorities who can help him clear the lien quickly.

Why Fiduciary Law is Good for Business

It might seem like a lot to take in, but it is the fiduciary responsibility that raises client confidence. You can honestly tell them you are bound by law to represent their interests loyally and fully. You can also explain to the client that this reduces the likelihood they will be taken advantage of by unscrupulous professionals.

Key Terms

Confidentiality

An agent is obligated to safeguard his/her principal’s lawful confidences and secrets. Therefore, a real estate broker must keep confidential any information that may weaken a principal’s bargaining position. The duty of confidentiality precludes a broker who represents a seller from disclosing to a buyer that the seller can, or must, sell a property below the listed price. Conversely, a broker who represents a buyer is prohibited from disclosing to a seller that the buyer can, or will, pay more than what has been offered for a property. The duty of confidentiality does not include an obligation by a broker who represents a seller to withhold known material facts about the condition of the seller’s property from the buyer, or to misrepresent the property’s condition. To do so constitutes misrepresentation and may impose liability on both the broker and/or the seller.

Fiduciary

A person in a position of trust and confidence, as between principal and broker; broker as fiduciary owes certain loyalty which cannot be breached under the rules of agency.

Fiduciary Duty

That duty owed by an agent to act in the highest good faith toward the principal and not to obtain any advantage over the latter by the slightest misrepresentation, concealment, duress or pressure.

Loyalty

An agent’s duty to place the client’s interest above those of all others, including the agent’s own self-interest.

Obedience

This fiduciary relationship obligates the agent to act in good faith at all times, obeying the client’s instructions in accordance with the contract.

Reasonable Care

The degree of caution and concern for the safety of himself/herself and others an ordinarily prudent and rational person would use in the circumstances. This is a subjective test of determining if a person is negligent, meaning he/she did not exercise reasonable care.

26.5a Fiduciary Duties Infographic

Please spend a few minutes reviewing the Infographic below.

26.6 Marketing the Property

Transcript

You finally have a client who wants you to sell their home. Your first listing! Now what? The Multiple Listing Service, or MLS, is the best way to market your listing.

Multiple Listing Service

The MLS is a suite of services used by real estate brokers and agents to exchange work (between the listing agent and the buyer's agent). The information in the MLS is also used during the appraisal process. There are actually a number of Multiple Listing Services that are arranged and managed by geographic region and that charge fees for using the service. They provide the most effective way to share information regarding a property.

Most leads from other realtors, or brokers, will find you in the MLS. So, it is crucial that you enter all the required information and write powerful, enticing property descriptions that stand out. The photos that you post are equally important in acting as a marketing tool to attract a buyer.

Most leads discover your listings through an MLS, so writing great property descriptions is crucial to a quick sale. Since the MLS gives you limited space for descriptions, include the desirable features first. Also, include photos that showcase the property’s best features and try to get unusual angles to catch the buyers eye. There are a lot of articles online with helpful suggestions for taking great photos and writing great property descriptions.

The Listing

Listings filed with MLS require the broker or agent to fill out a Property Data Form with the following information:

- Property class (single-family, residential, commercial, condo, etc.)

- Listing price

- Listing expiration date (typically 30, 60 or 90 days)

- Commission offered to another broker (the commission varies by area but typically between 2 to 3.5%)

- Other required information (number of bedrooms, number of bathrooms, patio, garage, pool and other major features)

For example, Charles Finnegan is a real estate agent with a subscription to the MLS. As part of his subscription, he gets a certain number of listings he can place each month. When he enters the information for the home, the Product Data Sheet might have the following information:

- Address

- Sales price

- County and State

- School District

- Total Bedrooms

- Total Bathrooms … and

- Remarks that will feature the main selling points of the home.

This is a greatly summarized version of a complete listing. The main thing to remember is to fill in as much information as possible that will help sell the home.

The remarks are the best opportunity to highlight the property's best features.

An example of an effective remark might be:

Center of town location for this newly renovated home. Beautiful kitchen with stainless steel appliances, new cabinets and granite. Move in condition.

Get the Best Photos and Video

Familiarize yourself with the best ways to get beautiful real estate listing photos. Use natural or artificial lighting to advantage, include high-quality indoor and outdoor pictures and improve curb appeal as much as possible. If the budget allows, consider getting a photographer or videographer to make the biggest visual impact.

The Other Guys

In today's digital world, there are a number of players in the online selling game that compete with the MLS and your direct marketing efforts. You can even sell a home on eBay now. Let's discuss a few of the top real estate sites that owners and realtors used to market a property.

- Zillow.com -- Launched in 2006, this Seattle-based company is the leading real estate marketplace. There is a wealth of advice and information on the site that is very helpful when it comes time to sell your property. The Zillow database includes more than 10 million U.S. homes.

- Trulia.com -- Trulia gives sellers the information and tools to sell their homes. This website provides insights about different neighborhoods in order to suggest listing prices. This website also connects sellers to agents for help with selling their property. Trulia is owned by The Zillow Group.

- Redfin.com -- Redfin links sellers to reputable and experienced agents. The company has facilitated over $20 billion in sales.

As an agent you will most probably use all these resources and a bunch more, which will be provided to you by your broker. So make sure you get familiarized with as many online resources as possible as that will make your life much easier.

Key Terms

Multiple Listing Service

An association of real estate agents providing for a pooling of listings and the sharing of commissions on a specified basis.

26.7 Exclusive Seller Listing Agreement Example

Please spend a few minutes reviewing the document below.

26.8 Exclusive Seller Listing Agreement Review

Transcript

In Georgia, when a seller wants to use a licensed broker to help list and sell their property, both the broker and the seller must sign a written agreement. In this lesson, we will review the Georgia Exclusive Seller Listing Agreement, which creates an agency relationship between the seller and their real estate professional. In other words, this is the agreement sellers use to hire brokers. When a seller signs this agreement, they are promising to give the broker the exclusive right to the listing.

Let’s start with Part A, which outlines the terms and conditions for the agreement. Understand that, when a seller signs this agreement to list their home, they are representing that they have full authority to do so. It’s also important to understand that the agreement is legally binding on both the seller and the broker; any changes must be agreed-upon in writing by both parties.

Section 1 defines the property subject to the agreement, both by its street address and by its underlying legal description, as recorded with the county land records office. The legal description should either be attached as a separate exhibit, refer to the county records deed book where the description can be found, or be documented in section 1(b)(3). Section 1(b)(4) applies only when the property is a condominium.

In Section 2, the parties should document the start date for the listing agreement and its end date. This time period is the “Listing Period.” There are two exceptions to the “end date” listed here:

First, if there is a signed purchase and sales agreement executed before the last day of this listing agreement, the Listing Period is automatically extended through the date of closing.

The other exception is if there was a purchase and sale agreement in effect during the Listing Period but that agreement ended up falling through for some reason, the Listing Period is extended by the time period that such a purchase and sale agreement was active.

For example, let’s say Seller Sally entered into an exclusive listing agreement with Broker Bob, from May 1 through November 1. On June 1, Buyer Barry and Seller Sally signed a purchase and sale agreement for the property. However, on June 30, that agreement fell through when Buyer Barry was unable to get financing.

Although the original end date for the Listing Period was November 1, it will be extended by 30 days because of the time the property was off the market with the purchase and sale agreement that didn’t work out.

Section 3 is where the parties should document the agreed-upon listing price for the property. It’s important to understand that both the seller and the broker have responsibilities to each other under this agreement. The broker is responsible for making required legal disclosures, using the broker’s best efforts to find a buyer willing to pay the seller’s asking price, comply with applicable Georgia laws, and, if applicable, help the seller with negotiating a sales price and with completing the purchase and sale agreement.

For their part, the seller is responsible for complying with the law, cooperating with the broker, and referring inquiries to the broker. Sellers are also agreeing to make their properties available for showings when prospective buyers want to visit. If the seller wants the broker to help them with negotiating and filling out the purchase and sale agreement, they should mark the first box in section 4. Otherwise, they should mark the second box, indicating that the broker is not authorized to help with those tasks.

Section 5 is used to document where the property will be listed. In other words, which Multiple Listing Service(s) the broker will leverage to help find a buyer. Brokers can use any type of media to list the property for sale, and by signing this agreement, the broker agrees to list the property within 48 hours on the MLS platforms listed in section 5.

Sellers should understand that when a broker lists the property on an MLS, the seller gives up some control over the listing. The property description, photos, and videos, if applicable, will be viewable on the third-party MLS platform. Sellers are warranting to brokers that they have full rights to use any photos or videos to market the property. Sellers also agree that they will leave all marketing efforts up to the broker, unless sellers obtain the broker’s permission to advertise the listing.

The seller is traditionally responsible for paying the real estate brokers’ commissions when selling property. Section 6(a) is the spot on this agreement where those real estate commissions are documented. The commission may be expressed as a percentage of the sales price, a fixed dollar amount, or some other calculation. In Section 6(b), the broker documents how much of the commission will be paid to the cooperating broker, if applicable.

In addition to documenting the amount or percentage of the commission to be paid if and when the property sells during the Listing Period, sellers signing this agreement are also promising to pay commissions under other circumstances too.

First, if the seller defaults on a purchase or sale agreement made during the Listing Period, the real estate commissions are due and payable.

Another potential scenario where the broker is still owed commissions is if the seller and buyer agree that they are going to terminate a purchase and sale agreement without the broker’s consent.

Finally, a third way the seller may owe the broker commissions even if the property doesn’t sell is if the seller refuses to accept a written offer for the full listing price in cash, the offer is not subject to contingencies, warranties, or restrictions, and the date of closing is between 30-45 days from the offer date.

Sellers should also be careful not to terminate an exclusive listing agreement with one broker and enter into another one with a different broker; if the property sells, they may owe both real estate brokers commissions!

Section 7 is where the parties document the length, expressed in days, of the “Protected Period.” This is a period of time after the end of the listing period or after the date the parties mutually agree to terminate the agreement. If during the Protected Period the seller sells or agrees to sell the property to a buyer who learned about the property during the listing period, the broker is entitled to the commissions specified in section 6.

Section 8 documents whether any other licensed real estate professional helping the broker is an employee of the broker or is an independent contractor. Although real estate brokers work hard for sellers, they are never considered employees of sellers. Instead, they are independent contractors.

Section 9 includes 7 different types of agency relationship the broker may provide. When completing this form, you should check the boxes for the types of relationships the broker is NOT offering in this agreement.

The broker may be acting as a seller agency, buyer agency, designated agency, dual agency, sub-agency, landlord agency, or tenant agency.

If a broker is representing both the seller and a prospective buyer in a real estate transaction, sellers should understand the potential implications of this type of dual agency relationship. The broker in such cases is representing parties whose interests may be adverse to one another. Brokers who are representing both sides of real estate transactions must disclose the dual agency relationship to both parties and obtain consent to serve both the seller and buyer.

Finally, the last section in Part A, Section 10, is used to address certain circumstances under which additional approval is required for the listing and/or ultimate sale.

Section 10(a) is used if a seller has filed for bankruptcy and the bankruptcy court must approve the listing. This section is also used in situations where a seller has filed for divorce and the divorce court needs to approve and specifically authorize listing the house for sale.

Section 10(b) is used to indicate whether a bankruptcy court or divorce court must specifically approve the purchase and sale agreement (as opposed to just authorizing the listing.) This section is also used to cover other special circumstances, including short sales, where the mortgage lender or lienholder must agree to accept less than they are owed, and situations where the seller does not yet own the property being listed.

If a third party is required to authorize or approve the sale, the onus is on the seller to meet such requirements.

Part B of the Georgia Exclusive Seller Listing Agreement includes more detail about each of the ten sections in Part A. You should read through this section in its entirety to better understand the provisions in this contract.

Now, let’s turn to Part C.

Section 1 in Part C contemplates the possibility that the seller may default on the exclusive listing agreement. In addition to being responsible for the agreed-upon real estate commissions as specified earlier in the agreement, a seller who defaults also owes the broker for out-of-pocket expenses and costs including mileage, printing and copying, and advertising costs, including expenses related to removing the listing from the MLS. Brokers also have the right to pursue other remedies when sellers default.

When signing this listing agreement, sellers also agree to submit a current and complete Seller’s Property Disclosure Statement within three days. If a Lead-Based Paint Exhibit is required because the property or any part of it was constructed before 1978, the seller also agrees to provide a completed GAR Form F54 within three days too. These requirements are formalized in section 2.

In section 3, sellers agree that they will do their part to keep their property safe and free of any hazardous conditions, so that prospective buyers and their agents can view the property. Sellers agree that their brokers are not liable if injuries or damage to personal property results.

Section 4 further protects brokers by spelling out specific limits on the broker’s responsibilities and potential liability. While this agreement gives the broker the exclusive right to list and sell the property, that exclusivity doesn’t mean the broker cannot represent other sellers or buyers, and does not mean the broker cannot show other properties to prospective buyers.

The broker is also not responsible for personally inspecting the property or disclosing information that is otherwise easily ascertainable. By signing this agreement, the seller acknowledges that the broker is not an expert and is not acting in a capacity as a legal professional, accountant, financial planner, mortgage consultant, or other roles other than their role as a real estate professional.

The seller also agrees to hold the broker harmless if something goes wrong related to the seller’s negligent actions, the seller’s failure to disclose complete and accurate information to the broker, the loss or theft of the seller’s personal property, damage to the property due to dangerous conditions or due to the seller’s failure to secure animals, or the seller’s failure to adhere to the terms of a purchase and sale agreement.

Unfortunately, fraud in real estate transactions is a real concern. In section 5 under Part C, the seller gives the broker authority to report suspected fraud to government authorities or mortgage lenders, as applicable and appropriate. Of course, most real estate professionals are not professional fraud investigators. Therefore, this item also includes the seller’s acknowledgment that the broker may not identify all potential instances of fraud, and that the broker could make “false positive” reports, flagging something as being suspicious when there is actually nothing illegal or fraudulent going on.

Section 6 in Part C is reserved for some standard contract provisions you may be familiar with by now, as you have seen many of these in agreements covered in other lessons.

Section 6(a) talks about arbitration, which is an alternative means of resolving disputes. By signing this agreement, the seller and broker agree that if there is a dispute about the listing agreement, they will go to arbitration rather than taking their dispute to court. They also agree to abide by the arbitrator’s binding decision.