Chapter 5 - Land, Real Estate and Real Property

Learning Objectives

At the completion of this chapter, students will be able to do the following:

1) Define and make the distinction between land, real estate and real property.

2) Define fixtures and provide at least one example.

3) List at least two economic characteristics and two physical characteristics of real estate.

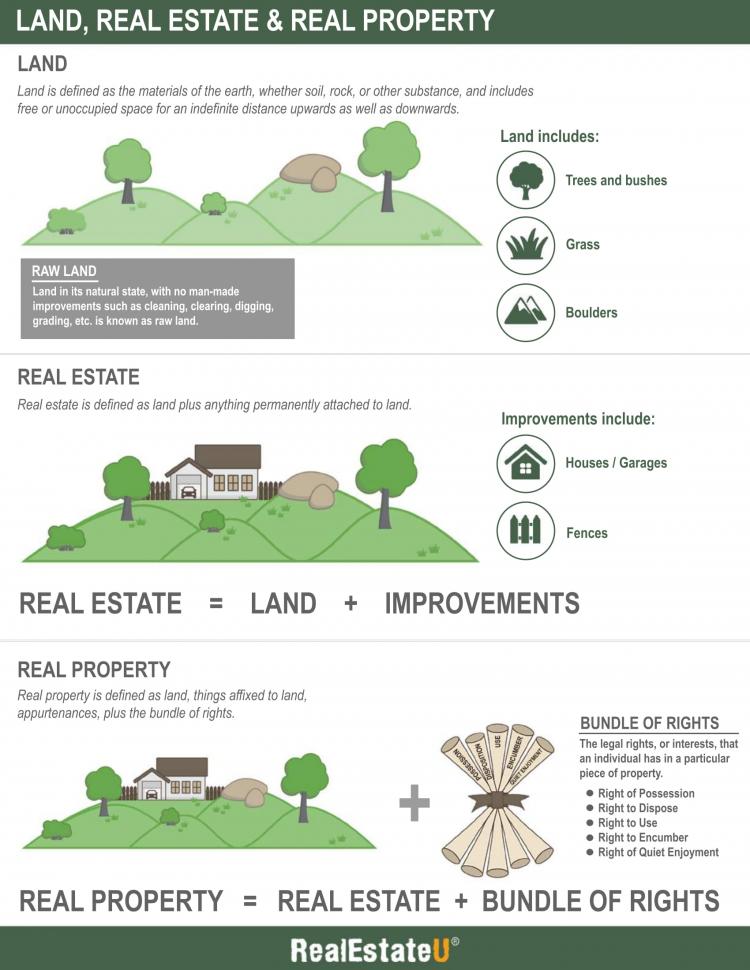

5.1 Land, Real Estate and Real Property

Transcript

We use the terms land, real estate, and real property interchangeably, and with little understanding of the implications of what these words mean. Understanding the field of real estate requires that we understand the nature of landed property, and the various rights of those who possess the property.

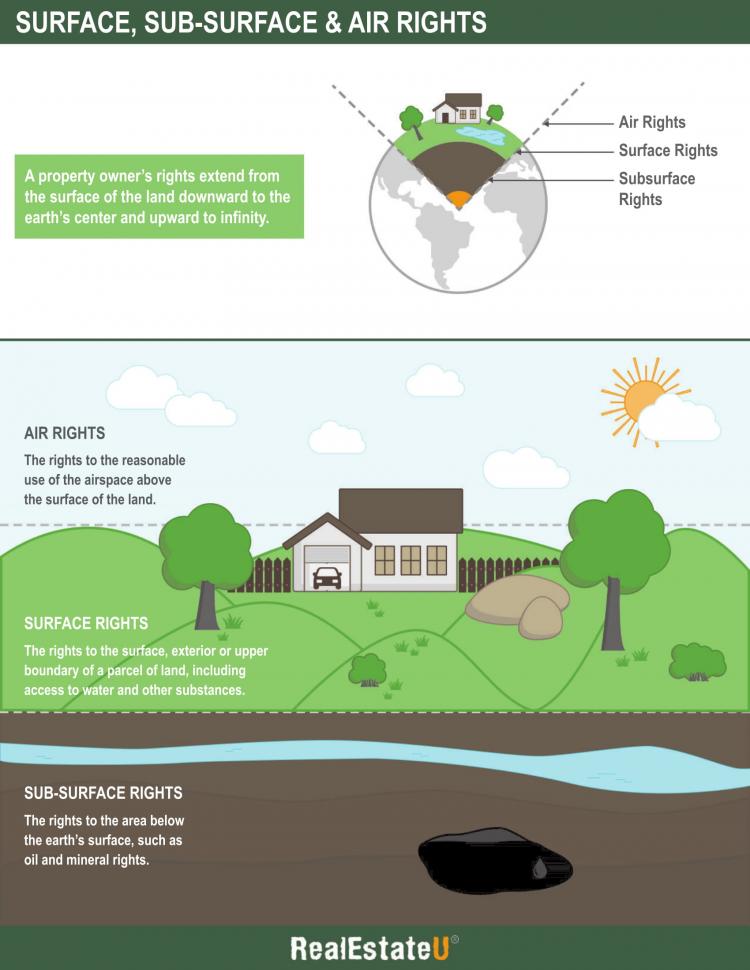

Our classical understanding of land ownership tells us that when a person owns land, they don’t just own the surface. They own everything from (and I’m quoting) “heaven to hell.” In other words, the owner of land also owns the air above the land up to the sky, and down to the center of the Earth. An entertaining image. But this has legal implications and raises many questions. Does this mean an airplane flying 36,000 feet above your house is liable for trespassing? Can you dig under your house even if it may cause damage to adjacent land? Can an owner sell their rights to the land above or below the surface? This is a concept of land ownership handed down to us from English law. In other countries, land ownership is different. For example, in Israel, a person can usually only own the right to build on the surface of the land. The government owns the land itself, and all the subsurface and air rights.

Let’s discuss these three different types of real estate.

Land means just the raw land. It doesn’t include any man-made structures on the surface, or below for that matter. This includes the trees and rocks and animals on the surface, including the fruit of the trees. When you own land, as we said, you own it from the heavens down to the center of the Earth. So, unless it’s already been sold, ownership includes the subsurface rights, and any minerals, oil or dinosaur bones found underground. All of that belongs to the owner. Ownership also includes air rights, to a point. You can build a house as high up as you want, as long as it doesn’t conflict with local zoning laws. And you can fly a drone or hot air balloon on your property. But unless you own an important building like the White House or Empire State Building, don’t expect to keep airplanes from flying above your land. The Supreme Court long ago ruled that your air rights are limited.

Real estate, the term we use most in daily life, means land plus man-made improvements. In modern times, improvements generally include a house, building or fence. If you’re working in rural areas, this can include a separate garage, barn, out-house, smoke house, silo, chicken coup, or anything else a person permanently installs on their land. These are called fixtures or appurtenances. When real estate is bought and sold, it includes the fixtures, those things that are built into the land.

A mobile home, a trailer, or wagon are not included with real estate ownership. They’re considered movable property or chattel. In a particular transaction they can be included, but a trailer or mobile house would have to be specially purchased from the prior owner and registered with a local government office separately from the rest of the real estate. Often, owners of mobile homes rent the land where their mobile home rests. It is an interesting problem for banks. During the economic crisis that began in 2008, when foreclosures by mortgage lenders were at all time high, many banks foreclosed on land thinking they repossessed everything found on the real estate. But, after inspecting what was taken at the foreclosure sale, they found a mobile home with a family living inside. The bank didn’t own the mobile home and had to specially evict the family and remove them from the real estate, mobile home and all.

Real property is the more esoteric concept of the three. Real property includes real estate and the rights that go with it. Law professors refer to this as the bundle of rights. Each stick in the bundle represents a right of the real property owner.

There are a lot of things that a person can do with their real estate. The rights an owner has to their real estate depend on the rights of the prior owner and what was conveyed to the current owner. The first rule of real estate transactions is that you can only convey that which you already have. You can only convey those sticks that you already have in the bundle. In simple terms, if you own the real property known as 100 Smith Street, you cannot sell the house located at 125 Smith Street because you don’t own it. That’s obvious.

But what happens if an owner of real estate sells the subsurface rights to his land to a drilling company, then sells the real estate to a new owner, who owns the subsurface rights? It’s still the drilling company. When the old owner sold the real estate to the new owner, he had already sold off the subsurface rights, so those rights don’t pass to the new owner. The “sticks” representing the subsurface rights had been sold to someone else. You can only convey that which you own.

Let’s talk about this bundle of rights. What does it included? Some of it may seem obvious, but you should keep in mind that each of these rights can be sold off or is limited by agreement or law.

The first is the right of possession. When you buy real estate, it is yours. The right of possession is exclusive, meaning no one else can possess it. You can share the right of possession. More than one person can possess real property. This is called joint tenancy. The right to possess property in the United States is sacrosanct and guaranteed in the United States Constitution. In order for someone to take real property from an owner, according to the Fifth Amendment (to the Constitution), there must first be due process. The right of possession can be violated by the government if someone committed a criminal act and the government gets a court order taking the property as part of a criminal conviction. It can also be violated if someone has a civil judgment against them and the sheriff seizes the real estate to pay a debt. Or, the right of possession can be violated as part of a condemnation case, where the government takes private real estate for the public good, like building a highway or a sidewalk. In that case, the owner has to be compensated the fair market value of the property taken. When there’s a dispute about the value, a court will provide a process to determine the fair market value. But in any case, there must be a court proceeding and judicial order for the right of possession to be violated.

The right of possession is a stick in the bundle of rights that can be bargained away. As we’ll discuss when we talk about the right to dispose and the right to encumber, real estate can be pledged as collateral. The right of possession can be violated when the real estate is pledged as collateral and the owner fails to make the payments. We call this violation of the right of possession… foreclosure.

With the right of possession comes the right of quiet enjoyment. This means no one can disturb you on your real estate. Excessive noise, toxic waste, and undermining are all civil or criminal violations of the right of quiet enjoyment. If your right is violated, you can sue in court for damages. The right of quiet enjoyment always has to be weighed against the right to use real estate, which is discussed in a few minutes.

A major question that courts have grappled with for decades is whether the right of quiet enjoyment includes the right to a view. For example, you buy land and build a new house with the windows facing west so you can enjoy the sunset in the evening. Then, the adjacent landowner builds a house to the west of yours blocking your view of the beautiful sunset. Has he violated your right of quiet enjoyment of the sunset? Most courts say no. There is no right to a pretty view.

An interesting lawsuit took years to resolve in Atlanta a few years back. A condominium development company built a condominium tower in a fashionable part of midtown. As part of the advertisement for early purchasers, the development company promised an unobstructed view of the Atlanta skyline. Those condominium owners with the view paid a premium for the benefit. Soon after the building was finished, another condominium development company bought a plot of land next to the new tower, and built a condominium tower of their own, blocking that beautiful, unobstructed view of the city! The first tower sued the second tower, and the condominium unit owners sued the developer for breaking the promise of an unobstructed view. The new question was whether the condominium owners could sue the developer for breach of contract or false advertising based on the promise of an unobstructed view. After years of litigation, going up and down the various appellate courts, the final decision was that no one has a right to an unobstructed view, and no one is entitled to damages, because it is well known that someone can always build another building blocking your view.

For the purposes of a real estate agent, the most important stick in the bundle of rights is the right to dispose. The owner of real property can sell all or part of their property. The owner can sell rights to property, like a leasehold interest, an easement across the land for a sewer line or walking path, or even a life estate. A life estate means that the property is owned by a person until they die, when it reverts to the original owner. The owner can even sell a limitation in his right to sell. For example, in certain condominium or co-op situations, the right to sell is limited to those buyers who are approved by a board of fellow owners. In a sad time in American history, the right to dispose was limited in some places on the basis of race. The right to dispose includes the right to bequeath the property in a will. The owner can leave the property to whomever he wishes. If the owner does not have a will, the property will pass to his heirs upon his demise, according to state law.

The right to dispose includes the right to convey other specific sticks. Granting an easement is the sale of a right to use a portion of the land. Often, the sale of an easement to build an underground sewer means that the owner is giving up the right to use that undersurface land for his own purposes. He may not be able to build on top of it either. Also, granting that easement to one party means that the easement cannot be granted to another party.

One can also dispose of undersurface rights in general. This is common for mineral mining or oil drilling. In states that are rich with natural resources, such as Nevada, Texas, and Kentucky, it is very common to see closings where real estate is conveyed, except for undersurface rights that have already been sold to a drilling or mining company. Land owners will do that in exchange for a share of the profits from the extracted resources. It is very expensive and difficult to drill for oil. While the real estate owner owns that oil, it is easier for him to give up the right to a professional company who can extract the oil and take a share of the profits.

One can also convey hunting rights. The wild animals on the land are the property of the owner of the land, even if they just wander on randomly. Part of the right to use the land is the right to hunt game, subject to local laws. In many rural areas, it is common for owners of large tracts of land to sell hunting rights, and make money for doing basically nothing, while others hunt on his land. If you work in rural areas with lots of forests, you will see large tracts of land for sale that are advertised as being good for hunting rights. While easements can usually only be sold to one person or company, hunting rights can be sold to many people.

With the right to sell or dispose comes the right to encumber. Encumber means to have a lien placed against the property for payment of a debt. The property can be pledged as collateral. The owner is handing over a stick from his bundle to a lender or other creditor in exchange for money. So if the owner sells the property with the encumbrance stick in the hands of a creditor, the new owner will be lacking that stick and the lien remains on the property. That’s why, in most real estate closing situations, all liens are paid off before the property is conveyed to a new owner.

Of course, with the rights to possess, enjoy, and dispose, is the right to use the real estate. The owner can sit on the land, farm it, graze cattle, build a house, hunt, or dig trenches. The right to use the land is usually subject to local zoning laws. In a residential area, one is not usually allowed to use the land to build a 40-story office tower or smelly factory. Similarly, if one’s use of the land disturbs others, you can be sued for damages.

One interesting case that pops up is referred to as the pig-farm situation. A person buys a house that is next to a pig farm. The owner complains about the smell and the sound, but the pig farm owner refuses to shut down his business. What should the owner do? When he files a lawsuit for nuisance and violating his right of quiet enjoyment, the owner finds that the case is dismissed. Why? Because the owner came to the nuisance. Generally, the rule is that one is expected to look at their surroundings before buying a property. If you are next to a pig farm, the smell and noise are to be expected. Now, reverse the situation. What if the newcomer is the pig farmer, who opens his farm next to a residential neighborhood? If the neighbors sue they will win, because the pig farmer is causing a new nuisance.

The right to use is limited in other ways. Can you have a rock concert on your lawn? That depends. Most localities have laws restricting the decibel level and hours when concerts can be performed. So while you may enjoy using your real estate to blast Metallica, out of huge speakers at all hours of the night, your neighbors might not. And their right of quite enjoyment to their property trumps your right to use your property in this way.

A common limitation on the use of land is restrictive covenants. When real estate is located within a planned community, homeowners association, or condominium, you will usually find restrictive covenants. The deed to the property will say whether the real estate is subject to restrictive covenants, and provide a cross reference to the deed book and page where the covenants can be found.

For most homeowners associations, the covenants will require that houses be kept in a similar fashion to other houses, even dictating paint color. They will not allow the real estate to be used for anything other than family living. Payments to the association will be required. Condominium covenants are very detailed and strict. They may limit what one can do inside their condominium unit. Too few buyers read the restrictive covenants before they buy a house. This could put them in a nightmare scenario down the line because of a misunderstanding about what rights they have and down have to use their own property. If a person in a community with restrictive covenants builds a deck on their property, and the covenants don’t allow it, the homeowners association can force the owner to dismantle the deck at their own expense, and pay the attorney’s fees and violation fines of the homeowners association.

Key Terms

Air Rights

The rights in real property to the reasonable use of the air space above the surface of the land.

Bundle of Rights

All of the legal rights incident to ownership of property including rights of use, possession, encumbering and disposition.

Land

The materials of the earth, whatever may be the ingredients of which it is composed, whether soil, rock, or other substance, and includes free or unoccupied space for an indefinite distance upwards as well as downwards.

Mineral Rights

A landowner’s right to receive a portion of the profits of any minerals that are extracted from the land.

Real Estate

Land plus anything permanently attached to land.

Real Property

Land, things affixed to land, appurtenances, plus the bundle of rights.

5.1a Land, Real Estate and Real Property Infographic

Please spend a few minutes reviewing the Infographic below.

5.1b Bundle of Rights Infographic

Please spend a few minutes reviewing the Infographic below.

5.1c Surface Rights, Subsurface Rights and Air Rights Infographic

Please spend a few minutes reviewing the Infographic below.

5.2 Real Estate vs. Personal Property

Transcript

The distinction between real estate and personal property matters a great deal when one is involved in real estate transactions. An important factor in any real estate deal is what will be bought and sold besides the land itself.

Real estate is raw land plus permanent structures on the land. This can include a house, fence, barn, office tower, garage, or any other number of structures. But what, in the house or building, is included? The stove? Kitchen cabinets? The toilet, light fixtures, or sink?

Everything that is not real estate is personal property. Personal property is also called movable property or chattel. Real estate transactions and personal property transactions are governed by different sets of rules and statutes. Let's drill down to really understand the distinction and how items are treated in a common real estate closing.

The land aspect of real estate we understand. It's the ground, from heaven to the center of the Earth, as defined by the boundaries in the deed. The land includes whatever grows on it, like trees, grass, and naturally occurring animals, like deer or duck. The land also includes whatever is underneath it, like mineral deposits, coal, or oil. The rights to these things, especially mineral rights underneath the land, can be sold to other people. The land or any structures can be leased out to tenants. Rights to easements can be granted across the land.

Real estate is land plus fixtures. Fixtures are things attached to the land or improvements made to the land. The technical term you'll find in deeds and contracts is appurtenances. Fixtures generally cannot be removed, at least not without significant damage to structures or the land itself. Fixtures include buildings, plumbing, wiring, built-in cabinets, and sometimes appliances. Fixtures also include wells, underground storage tanks, sewer systems, and mines. Whether something is a fixture or moveable property is a legal question. A handy tool to determine whether something is or is not a fixture is to apply the mnemonic device "Maria", M.A.R.I.A.

M is for “method” of attachment. How is the item attached to the land or structure? A house usually has a foundation that is dug deep into the ground. A well is dug into the ground and surrounded by brick or concrete. A barn may have a small foundation, but certainly cannot be moved. There is no question that these are fixtures.

Pipes are built into the house and attached to the local sewer line. Electrical wires run throughout the house behind the walls. Cabinetry in the kitchen is securely nailed to the walls. A fireplace is built into the structure. A sink is glued into the countertop which is, in turn, glued to the wall or attached cabinets. These items can be physically removed if one tries hard enough. In fact, when banks or new owners entered many foreclosed, homes, they found that the copper wiring was removed. Just ripped out of the walls. Copper was fetching a high price on illicit markets. And former owners wanted to cash in as much as they could after leaving their property. The phrase "take whatever isn't nailed down" was taken to an extreme. Most people would agree that these methods of attachment, being built into the walls, establish a fixture. But a light fixture can be screwed into the ceiling. A television can be mounted on a wall, but easily removed. These items are questionable, and we must look at other factors.

A is for “adaptability”. Is the item custom built for its space? Can it be removed and adapted to a different space? Kitchen cabinets likely cannot be adapted to another space, nor can they be removed without significant damage. However, a mobile home, while heavy, can be moved without damage to a new space. Similarly, a television, even a wall-mounted unit, can be adapted to a new space with a new mounting. Pipes and wiring are made and installed in a way that fits the building where they operate. While individual pipes could be removed in certain places, removing all and using the same ones in another structure would be extremely difficult. In the case of pipes, cabinets, and electrical wiring, we're likely to say that those are fixtures. However, since a television could work in any house, unless it's physically built into, and made a part of, the wall, it will be considered movable property. Light fixtures always present an interesting problem. An expensive chandelier isn't something a discerning homeowner wants to leave behind. It may have been purchased to fill that particular space, and installed with great expense, but it can be removed and placed in another living room in another house. It is adaptable. However, recessed lighting, while also a light fixture, usually cannot be removed and adapted to a new space. New holes would have to be drilled into the ceiling. And the original home will be left with empty holes. That makes a house far less marketable or desirable.

Similarly, the HVAC units for the home may be a questionable item. In-window or in-wall units are fairly easy to remove and are not adapted for the space. However, a central air conditioning or central heating unit, with the operating unit outside the building, but the duct-work inside the walls is more likely considered adapted for the space and not adaptable for another building. For questionable items like light fixtures and appliances, we have to look at the next factor.

R is for “relationship” of the parties. If there is a dispute between the buyer and seller on whether or not an item is a fixture or personal property, courts will generally favor the buyer's opinion. For example, let’s say there is a contract for the purchase and sale of real estate that says the sale includes “all fixtures.” In the house, there is a $6,000 Viking stove. When the house was shown, the stove was present, and it was present in all advertising photos. The buyer purchased the house thinking the stove was included. After the closing, when the seller is moving out, he attempts to load the stove onto his moving truck. The buyer brings the seller to court demanding that the stove be left behind because it is a fixture and part of the sale. But the seller says the stove was not built into the walls, simply plugged in, it was not custom built for the space in the kitchen, and it can just as easily fit in his new house as his old house. In jurisdictions where the courts favor the buyer on these close calls, the buyer will win the case. Why? Because appliances that look built-in and presented as part of the house, can be fixtures, and the seller should have been more specific in the contract about what was and was not included. Similarly, with expensive light fixtures, other appliances like a refrigerator, air conditioning and heating units, the question of whether they are fixtures or personal property may end up hinging on the court's interpretation of these ambiguous items.

I is for the “intent” of the seller. When the seller installed the item, did they intend for the item to be permanent? If so, it will most likely be determined that the item is a fixture to the property. For example, if a seller installed built-in bookcases and custom shelving, it is plausible to assume these items were intended to be permanent and therefore considered a fixture.

Which brings us to the final letter A. A is for “agreement”. The most important factor in determining whether an item is or is not a fixture is the written contract between the parties. If the agreement says that the stove is a fixture and it is included in the sale, then so it is. There is no substitute for a thoroughly drafted, complete, and understandable contract. While there is a movement to simplify written documents to make the process look easier to clients, it can ultimately cost clients thousands in the end. Many states have form contracts prepared by attorneys or local real estate broker associations. These form contracts are valuable tools, because they keep up with the latest trends in case law and are edited each year in response to better understood needs of agents and clients. However, they’re not meant for every situation, and be general or vague, particularly about fixtures. It is the agent’s responsibility to sit down with the parties and fill in the blanks. Ask, what will or will not be included in the sale? Appliances, furnishings, a storage shed, light fixtures, are all things that are questionable and negotiable. A few extra minutes going through these details will save both parties (and you) months in court.

If something is not a fixture, then it is personal property, or chattel. Personal property is goods that are movable, or immovable, but are not real property. Personal property is governed by a different set of laws than real property. The most common personal property in real estate is furniture. Everything from the bed, couch, lamps, and rugs, to electronics. If you can carry it away, it’s certainly personal property. Certain appliances may be personal property. For example, a microwave that is not built into the wall is personal property. A refrigerator is likely personal property. The washing machine and dryer are likely personal property. A smoker out in the yard, a playground, or storage shed can also be personal property.

Whether or not personal property is included in a real estate transaction depends on the contract. As we said before, it is wise to go through the house and decide what will and will not be included in the sale. Many homeowners don’t want to carry a refrigerator or pay the cost of moving a washing machine, so they’ll leave it behind and add value to the price of the house. Owners that are relocating to smaller apartments will usually leave behind furniture that fits a house, but not a small apartment. But to make sure there is no confusion, include in the advertisement for the property, and the contract, exactly what will stay when the sale is complete.

The different rules around real and personal property play out in the foreclosure context. Many of the properties on the market today are houses that were foreclosed during the Recession, and are being resold by banks or other investors. When real property is foreclosed by the bank, it only covers the real estate. Personal property is still the property of the prior owner. Foreclosure does not include furniture, the television, or the piano. Often after a foreclosure, the bank that buys the property has to institute an eviction case to remove the prior owner and their belongings. If the prior owner disappears and leaves behind their clothes, pots, and furniture, after a period of time, that property can be deemed abandoned. The bank is stuck with it, and will pay for a removal company to take the items out and dispose of the personal property somehow.

Different rules for personal property also apply to liens. Liens for real estate are recorded with the real estate clerk of the county where the property is located. However, liens on personal property are usually in the form of a UCC-1 statement. A lien on personal property is usually placed when the item is bought with lender financing. This is common with furniture and expensive electronics. If the owner doesn't pay according to the terms of the loan, the lender uses the UCC-1 statement as a basis to file a lawsuit and take back the property.

In commercial property, fixtures are treated differently than residential property. In residential property, it is expected that fixtures like cabinets, lights, and appliances will remain with the house as fixtures when the property is sold. In commercial property, unless it's specified in the contract, the new owner expects to take the property almost as an empty shell. That means all fixtures are removed.

Fixtures in commercial property are usually referred to as trade fixtures. Trade fixtures are considered personal property and are usually removed when a building is sold or a lease term is completed. Trade fixtures typically include display counters, manufacturing equipment, computers and servers, registers, store shelves, business signage, sales racks, and even ceiling tiles. Trade fixtures are usually specific to the business that operated in the building. If the previous owner manufactured metal fittings, then the hair salon moving in will have no need for the equipment, and won't want to incur the expense of removing and selling off the manufacturing equipment. Similarly, the clothing store that follows the hair salon will have no need for barbers' chairs, mirrors, and stylist work stations that were used by the salon.

Another reason trade fixtures tend to be removed when the prior owner moves out is that the trade fixtures often have a lien on them. Many commercial loans, whether for real property, personal property, or revolving credit for operating cash, include a lien on all trade fixtures. The business owner will need the trade fixtures in his new facility both to continue his business, and to serve as collateral for future loans.

An interesting question with commercial property is whether the HVAC unit, usually found on the roof, is a trade fixture to be removed or a part of the permanent structure. In this case, it is best to go back to 'A', the agreement. Careful drafting of the commercial real estate contract is crucial. While a home, in-wall air conditioning unit may cost a few hundred dollars, commercial grade HVAC units cost tens of thousands of dollars, depending on the side of the building. Similarly, with trade fixtures, it is important to draft an agreement that accounts for all of the existing fixtures and improvements made to the building. Sometimes the new owner will want the building restored to its original condition. Sometimes simply removing the trade fixtures is enough for the new owner. While your local real estate agent association may have pre-printed agreement forms for commercial real estate transactions, it may be wise to enlist the assistance of a local attorney who can draft an agreement that will set out the intent of both parties.

So far we've discussed residential property, commercial property, and industrial property. But what about farms? More than half of the United States is farmland. Anyone working outside of a city will encounter farm land transactions at some point in their career. The differences are stark. The acreage will be considerably larger. But there will usually be a house with usual fixtures. A farm transaction also has out-buildings that may or may not be fixtures depending on how they're constructed. The barn, chicken coup, smoke house, equipment shed, and grain silo are all likely to be considered fixtures that remain with the property. Tractors, threshers, and other equipment will usually be considered movable property.

But farms bring up a special issue of personal property. Emblements. Emblements are crops, seasonal and annual plantings. Emblements, while physically attached to the ground, are considered personal property. Crops does not just mean wheat or soy. Crops include apples, strawberries, potatoes, and anything else that grows above or below the ground. On land that is used to harvest wood, the trees themselves are also a crop, considered an emblement. They are the personal property of the farmer or cultivator. The unique status of emblements is a consequence of the history of farming.

A farmer who owns the land and plants his own crops keeps them as his personal property. Crops can be pledged as collateral separate from the land itself. Even future crops, those not yet planted or harvested, can be pledged as collateral. The lien is similar to other personal property. The right to plant and harvest crops can be leased or sold to another person. In other words, one person can own the land, and another person can plant crops, harvest them, and sell them. This is because the crops are separate, personal property from the land itself.

Issues arise with tenant farming. A tenant farmer rents the land from the owner to cultivate crops. The crops should be the property of the cultivator, namely the tenant. But the landlord usually has a lien on the crops. And it's not uncommon for the tenant to give some of the crops to the landowner as part of the rent payment. When there is a disagreement among the parties, questions arise as to the ownership of the crops. The owner claims they're on his land. The tenant says he cultivated them. A court would have to go through a lengthy analysis to make a final determination of the status of the crops.

A lucrative business in many regions of the country is timber farming. In the south, pine and bamboo forests are very popular investments. An investor would buy the land, and sell the rights to the naturally-growing pine trees on the land. The owner doesn't really have to do anything. There's usually no planting. The harvesting is done by professional lumber companies who pay the landlord for the timber by the ton or by the acre.

Key Terms

Chattel

Goods or every species of property movable or immovable which are not real property. Personal property.

Emblements

The crops and other annual plantings considered to be personal property of the cultivator.

Fixtures

Appurtenances attached to the land or improvements, which usually cannot be removed without agreement as they become real property; examples – plumbing fixtures, store fixtures built into the property, etc.

Personal Property

Any property which is not real property.

Trade Fixture

Articles of personal property annexed by a business tenant to real property which are necessary to the carrying on of a trade and are removable by the tenant.

5.2a Fixtures Infographic

Please spend a few minutes reviewing the Infographic below.

5.2b Personal Property Infographic

Please spend a few minutes reviewing the Infographic below.

5.3 Characteristics of Real Estate

Transcript

Real estate is many things. There are characteristics of real estate that distinguish it as a certain type of asset and a certain type of property. These characteristics govern the rules of how we treat real estate and real estate transactions. The legal characteristics of real estate, land, and real property are covered in another lesson. Legally speaking, real estate is land with defined boundaries and things upon it. When we talk about ownership of real estate, we talk about a bundle of rights. The owner of real estate can do many things with it, like use it, enjoy it, sell it, divide it, pledge it as collateral, and let others use it.

But real estate has other characteristics as well. There are economic characteristics of real estate that relate to how and why real estate is bought and sold. And there are physical characteristics of real estate. The physical characteristics distinguish real property from personal property.

Let’s first look at the economic characteristics of real estate.

When you take an economics course in high school or college, the first and most important lesson you learn is that economics is really the study of scarcity. There is only so much of everything in the world… money, water, bread, and time. When you make decisions about what to do each day, your decisions are governed by scarcity. There are only 24 hours in a day. And some of those hours must be spent sleeping. If you choose to watch a movie, you give up 90 minutes that could have been spent exercising, reading, or working. Scarcity will dictate price. Price is what one is willing to give up to obtain the good or service.

Land is one of those things where scarcity is a major economic factor. There is only so much land in the world. Of that land, there is only so much that is habitable. Not much demand for condos in Antarctica or the Sahara Desert. Even in habitable regions, you can only build on certain types of land. Mountains, canyons, and swamps are not ideal places for a townhome. And of the habitable land, much is reserved for forest, farming, and other non-residential or commercial uses. So, when it comes down to it, there’s a limited amount of land for the 7 billion people on Earth.

Once the land is owned by someone, there is less land available. In the United States, every parcel of land was divided, owned, and accounted for by the late 19th century. Every piece of land was owned, either by a person, a corporation, a railroad, or the government. So, one can’t simply take land as one could drink water from a lake (after it’s purified, of course). One has to pay for real estate. And as with the general definition of scarcity, the price one will pay depends on how scarce similar real estate is on the market.

Scarcity and price are influenced by the next economic factor, location. There’s an old joke… “what are the three most important things in real estate? Location, location, location!” As an economic characteristic of real estate, this may hold true. Most of the value of real estate is tied to where it’s located. This works hand-in-hand with scarcity. Sought after places have less available real estate. This will increase the price. New York County, or as we call it Manhattan, has some of the highest real estate prices in the world. Why? Because there’s so little of it. It’s an island. You can’t simple build out. And so many people want to live there. Manhattan is the center of world commerce, entertainment, the arts, and countless other industries. There are also abundant jobs, schools, universities, and city services. The available jobs in Manhattan are generally higher-paying than most of the country. The cost of living is, therefore, also very high. The location of Manhattan real estate makes the real estate inherently valuable.

Compare this with real estate in New York’s Southern Tier. This region is among the poorest in the state. And real estate located in this area is among the least expensive. Why? There are fewer people, there are fewer jobs, and most of those jobs are low-paying. There is little in terms of the arts, sports, entertainment, restaurants and shops, relative to Manhattan. The population in many towns in this area is shrinking. It’s a generally rural area with plenty of space for people. It’s less finite than an island like Manhattan. Land located in this part of the state has a different economic dynamic than in a major city.

Suburbs are also an interesting mixture. Real estate located in certain suburbs is seen to be a compromise to city living. For example, the suburbs of central Long Island tend to have cheaper real estate than Manhattan. But real estate in this area is a fairly short commute to Manhattan. So, real estate located here will have a higher economic value than in further reaches of the state. The value is lower than Manhattan itself, because it lacks the jobs, cultural institutions, and population of Manhattan. But it is close enough to provide easy access to Manhattan, thereby making it inherently valuable real estate. The value of this real estate, located a short distance from the city, is tied to the significance of real estate nearby.

There are some suburbs where real estate can be found that’s even more valuable than a major city. The economic characteristics of real estate in elite neighborhoods is an interesting phenomenon. The Hamptons, located on the southern shore of Long Island, has some of the most expensive real estate in the world? And why? It’s not near New York City the commute is around two hours, but the location itself is attractive. Rich people settled there and build huge, expensive estates. People wanted to live near those rich people, which drives up the prices. The result is that only the wealthiest can afford to live there. Real estate in the Hamptons is located near expensive shops, restaurants, and services, which cater to the needs of wealthy neighbors. So, the economic value of real estate is tied to the wealth of the people that want to live there. Wealthy people want to live in Manhattan, so the market can allow prices to be very high. Whereas more middle class and working class people want to live further from the city, and the economic value of the real estate there reflects the demand.

The location of real estate is not only about cities and rich people. The geography and topography of real estate impact the economic characteristics. Coastal land, near beaches, tends to be more expensive than land further from the shore. The reason being that people want a view of the ocean or a lake. And that land is far scarcer than locations more inland. There’s only so much sea shore.

Sometimes this desire for land with a beautiful view comes at a price. Florida coastal land, while valuable and desirable in the market, also faces hurricanes every few years. There’s a good chance a house on the beach can be destroyed. And yet, the real estate is still expensive. Similarly, the coastal cliffs of southern California have very high real estate values. Even though mudslides can relocate the land to the ocean hundreds of feet below.

Location of real estate can have a negative economic impact as well. Land located near canyons, swamp, steep mountains, desert, or tundra tends to be less valuable. The reasons are obvious. It’s very difficult to build anything useful, or live easily in these types of environments. Roads are difficult to build making the property inaccessible. Bringing utilities like water, sewer, and electrical service is difficult in isolated areas. All of these factors diminish the economic value of this type of real estate.

Improvements built on real estate are a significant economic characteristic. Raw land has a certain value. But once a house is built on it, the value goes up considerably. Other structures like a pool, fence, driveway, and high quality gardening also impact the value of real estate. Improvements also include pipes, connection to a sewer line or sump pump, electrical wiring, and in modern times, phone and internet connection. These connections can be above or below ground. If the land is meant for agricultural use, improvements like a barn, shed, grain silo, chicken coop, or processing buildings increase the value. When there are no improvements to the land, a new owner will have to build them himself. This lowers the economic value of the land.

Another economic characteristic of land is that it is not liquid. One cannot easily exchange land for anything else other than cash. Land has to be sold for cash to be liquid. This makes land a permanent investment. Once you buy it, you can own it forever. The value may go up or down, but it is land and it is yours as long as you don't sell it or allow it to get foreclosed.

Because real estate is not liquid it is seen as a good, safe investment. Gold can physically be stolen, as can cash or other valuables. But because land is not movable, it can't simply be taken away. If one attempts to steal land by occupying it, they will find that laws have been built up over the centuries to make it extremely difficult. In the United States, a court of law has to say that land was taken by occupation, or adverse possession.

So, while real estate is difficult to sell or exchange for anything of value because of its illiquid nature, it is also a safe investment because it is hard to steal.

Land also has physical characteristics. While economic characteristics can be found in other types of property, physical characteristics distinguish land from most other types of property and investment.

Land is immobile. You can't move it. Once the boundaries are established in the deed, that is the real estate until the boundaries are changed by adding or subtracting land. This distinguishes land from other personal property. You cannot bring it anywhere, or change its location to change your rights or obligations. If the neighboring county has lower real estate taxes, you can't move the land over. Even if one took an excavator and physically moved the dirt or house, the land remains where it is.

Real estate is indestructible. The structures on the real estate can be destroyed. Fixtures, movable property, buildings, and other improvements can all be damaged or destroyed. But the land itself, even if you dig a giant hole in it, is still the same land. Ownership rights don't change. This can be distinguished with any type of movable property. A car can be destroyed. One may still have title to it, but the car itself can be turned to cinder with a strong fire. The strongest fire will never destroy land. It may destroy trees, grass or structures, but the land underneath remains. And the ownership rights of the owner remain unchanged. Land is called a permanent commodity. Commodities like oil, cattle, and natural gas can all be consumed and destroyed. Once consumed they are gone forever. However, land, no matter how much you use it, remains within its boundaries.

Real estate is unique. Each parcel of land is unlike any other on Earth. There, of course, can be similar tracts of land. But the land within the defined boundaries of the deed is unlike any other. In fact, if you have a deed with a matching legal description from another deed, or even an overlapping description, you have a very serious title problem. Because land is unique, this plays into the economic characteristics of land. Land is scarce, because you can't replicate or duplicate the same parcel of land. If a person wants land on a particular spot on the beach, or a specific distance from an important landmark, the one parcel in existence is the only one there will ever be. While gold may be inherently valuable because society says it is, land is valuable precisely because, unlike gold, there is only one of each parcel in the world.

Early in America's history, there were cases where deeds to the same property caused conflict. Real estate being unique, two people couldn't own the same parcel of land. One famous case, Johnson v. McIntosh from the early 1800s, involved a deed to land given to one family by a native American tribe, and a deed to overlapping land by the United States government. The Supreme Court had to decide who owned the real estate: the family that got the land by deed earlier, though from Native Americans, or the family that got the deed later, though from the United States government. The Supreme Court ruled in favor of the later family, enshrining the Law of Conquest into American jurisprudence. Even though there were Native Americans on the land first, the United States government, as successor to the King of England gained the land by conquest. And since two parties cannot make a claim to the same land, as each parcel is unique, the United States government's claim to the land was superior, because it conquered all of the land from the Native Americans... even land they did not see until centuries later.

Sometimes the architectural design of a building or house on real estate can increase the property's value. Structures on land are a physical characteristic. Like trees or crops they can be added or subtracted. They're not permanent, but tend to be around for a long time. Having a structure itself usually adds value to land. The quality of the structure can significantly add to the value of the real estate. For example, a 2 bedroom, modest home on 1/2 an acre of land would add some value. Raw land in a suburban area has value because of the potential of building a house. But once the house is there the value goes up. A modest home, similar to others in the area gives it a similar value.

But, if a large mansion was built on that same land, with 6 bedrooms, multiple bathrooms, a tennis court, and a pool, that real estate will be worth significantly more than if there were a modest home in the same space. The reason being that people will pay a premium for a better home, even if it's on the same type, size, and general area as parcels of land around it. If the home is architecturally significant, with a unique design by a known artist, the value could go up even more.

Of course, there is a downside to architecture and the value of real estate. If a house is a particular eyesore, is not pleasing, or is designed in an awkward way that makes it difficult to live in, the structure may actually decrease the value of a home. For example, in suburban Atlanta, in a neighborhood of modest, but tasteful homes, one homeowner decided to put an indoor pool in his basement. This was certainly unique. His was the only pool in the neighborhood that was indoor. When it came time to sell the house, the owner listed it on the market for $100,000 more than the neighboring properties. His justification was the pool in the basement. The property sat on the market for months and then years. No one wanted the pool. It was very expensive to maintain, and the humidity caused damage to the underside of the house. The owner had to reduce the price significantly, so that a new owner would have extra money to fill in the pool and restore the basement to its original form.

If the structure on land is iconic, then it will increase the value. The land where the Empire State Building sits is certainly far more valuable than most any other office building in Manhattan. Marketing for new buildings and new houses often emphasizes the iconic nature of the building on the land. In addition, there are names, or brands, synonymous with luxury such as Ritz-Carleton, Four Seasons, and Hilton. A recent trend in condominium development has been to license these names to make the condominium units more valuable, simply because of the name and the image of luxury they evoke.

Key Terms

COPYRIGHTED CONTENT:

This content is owned by Real Estate U Online LLC. Commercial reproduction, distribution or transmission of any part or parts of this content or any information contained therein by any means whatsoever without the prior written permission of the Real Estate U Online LLC is not permitted.

RealEstateU® is a registered trademark owned exclusively by Real Estate U Online LLC in the United States and other jurisdictions.